Introduction: Recent Development of Bitcoin and Inflation Patterns

Recently exceeding $69,000, bitcoin corresponds with indications of American inflation rate reduction. Market watchers are keenly monitoring these economic statistics as the Federal Reserve gets ready for its forthcoming meeting in order to project any effects on the bitcoin market.

Inflation and Its Affect on Federal Reserve Policy Making

Little change in U.S. consumer prices in June points to a slowing down of inflation. Along with a declining job market, the Commerce Department noted that consumer spending also slowed somewhat, which would indicate a trend toward the 2% inflation target of the Federal Reserve. Following little change in May, the price index for personal consumption expenditures—a main inflation indicator favored by the Fed—rose by 0.1% in June. Over the past year, this index has rise 2.5%.

Market Forecasts on Interest Rate Reductions

The market for cryptocurrencies stands to be much changed by the possibility of a rate cut. Reduced borrowing might encourage investment in riskier assets like Bitcoin. By year’s end, some analysts project Bitcoin’s price to be $100,000. CoinGecko’s statistics shows that Bitcoin is trading right now at about $69,200.

Fed’s forthcoming policy meeting and market expectations

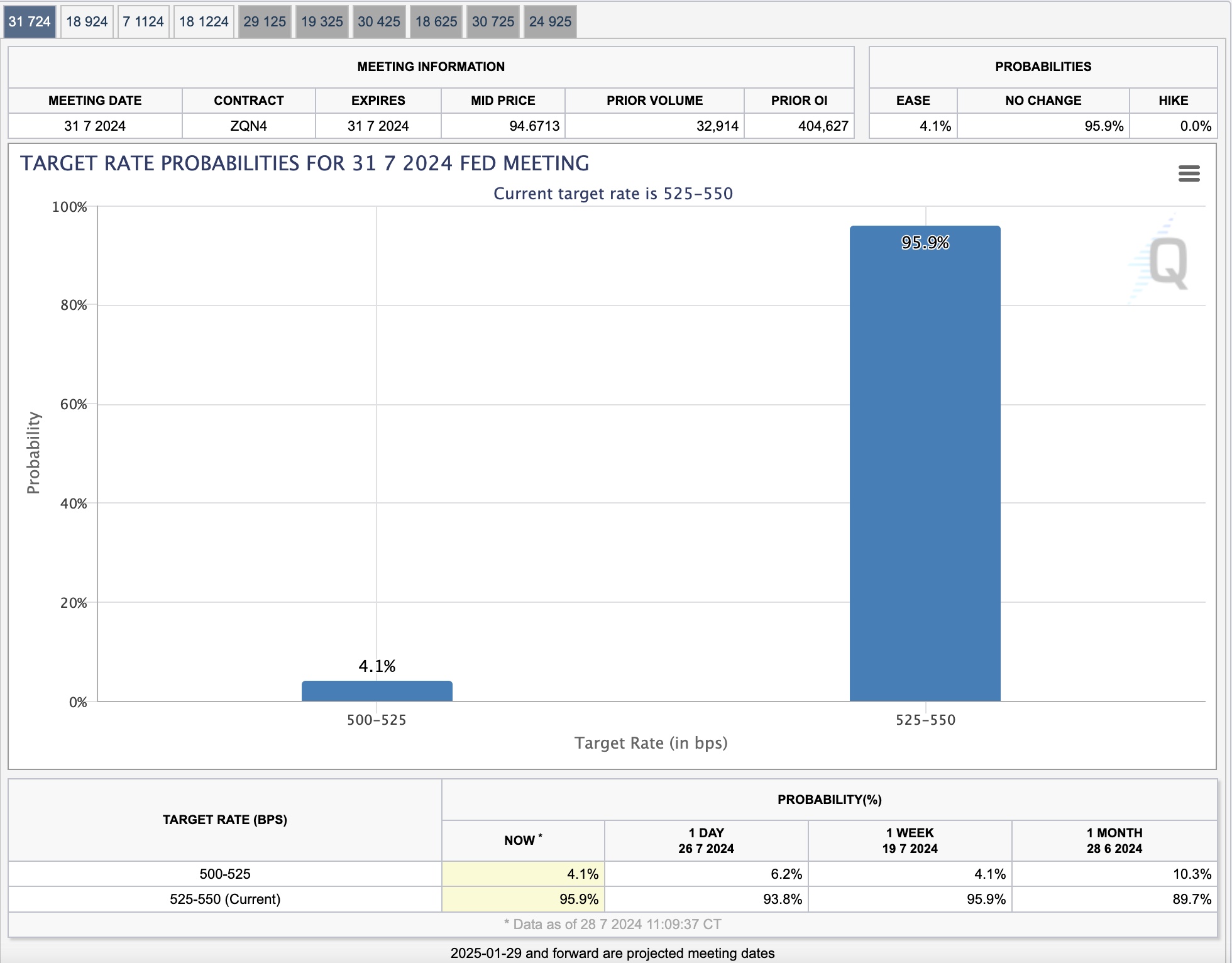

Next policy meeting of the Federal Reserve set for July 30–31. The CME’s FedWatch program, which examines Fed funds data from derivatives traders, indicates a 95.5% chance that there won’t be a rate drop this month. September has an 85% chance of a 25 basis point cut, nevertheless, with a 14% risk of a more notable cut.

Political Aspects Affecting Fed Activities

Political factors also influence things, particularly in view of the approaching U.S. presidential contest. Regarding interest rates especially, former President Donald Trump has advised Fed Chairman Jerome Powell against letting political considerations shape monetary policy choices. Seeking re-election, Trump has proposed that any rate decreases prior to the election could boost voter economic confidence, therefore supporting his campaign.

The Prospectues of Bitcoin Among Political and Economic Uncertainties

Industry analysts believe that the political environment in the next months may be quite related with the performance of Bitcoin. Co-founder of trading company GSR Rich Rosenblum observed that the value of Bitcoin may match Trump’s chances of re-election. Declaring intentions to build a “strategic Bitcoin stockpile,” Trump said at the Bitcoin 2024 conference that he will keep all of the Bitcoin the U.S. government now possesses.

In the end, negotiating a changing political and economic terrain

The bitcoin market is about to undergo major changes as inflation shows signals of slowing down and the Federal Reserve muses over its next monetary policy actions. Particularly in view of approaching elections, the interaction between political policies and economic data gives the financial environment layers of complexity. A gauge of more general market mood, bitcoin is particularly vulnerable to these swings.

The course of the market will be much influenced by the Federal Reserve’s attitude to interest rates, shaped by political demands as well as economic situation. A slowing down of rates might cut borrowing expenses, therefore increasing the demand for risk assets like Bitcoin. On the other hand, any sign of continuous rate increases could slow down market excitement.

Moreover, the political debate on bitcoin control emphasizes the rising relevance of digital assets in national policy debates by integrating recent remarks of powerful people. As former President Donald Trump and others spotlight Bitcoin in their platforms, the possibility for legislative changes looms big, impacting both market confidence and strategic orientation by investors.

For those engaged in the market, remaining knowledgeable and flexible is absolutely vital in this ever changing terrain. The future of the bitcoin market will surely be shaped as political and financial stories change. As they negotiate these uncertain but exciting waters, investors must so be alert, juggling hope with caution. For those working in the digital asset field, the junction of economic policies, legislative changes, and market mood will determine the road forward. This is therefore a critical junctur.

For further reading on inflation trends

Learn more about the Federal Reserve’s upcoming policy decisions on the Federal Reserve website.

For further insights, visit our cryptocurrency website

Be the first to comment