Table of Contents

Bitcoin’s Dramatic Decline

Monday’s Asian trading hours saw a notable decline in Bitcoin (BTC), which dropped below $50,000—a level not seen since mid-February. TradingView data shows that the biggest cryptocurrency in the world dropped to $49,112 before somewhat recovering. The native token of the Ethereum blockchain, ETH, dropped to $2,060—its lowest since January 3. Tracking the most liquid non-stablecoin tokens, the CoinDesk 20 index slumped almost 20%.

————

Ether’s Steep Fall-off

Ether’s worst single-day hit since May 2021 was a near 25% slide. Rumors that Jump Trading, a maker of cryptocurrencies, was selling assets helped to explain some of this fall. Suggesting possible liquidation, on-chain investigator spotonchain found a wallet purportedly belonging to Jump Trading that moved 17,576 ETH, valued more than $46 million, to centralized exchanges.

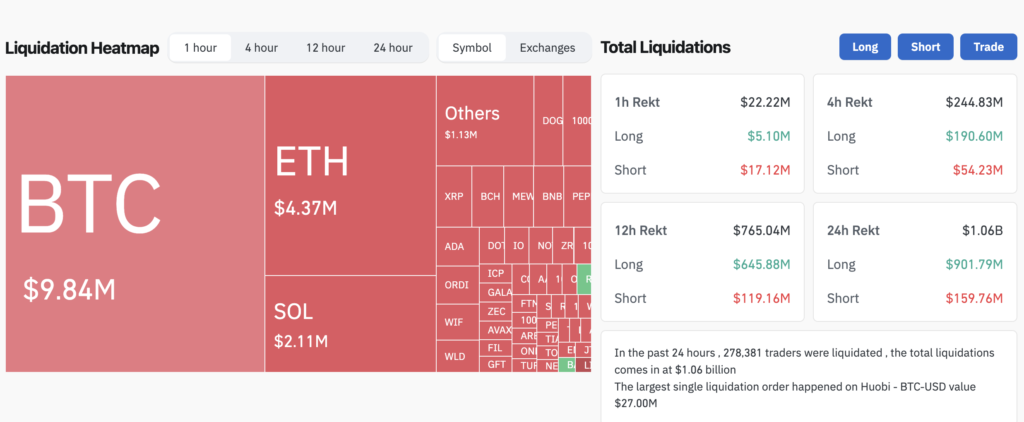

Widespread Liquidations

Over $1 billion in liquidations in the crypto futures market resulted from the sharp drop; Ether registered over $350 million in liquidated bets. Rising Middle Eastern tensions and worries of a global recession set off a more general financial market downturn that led to this panic selling. The Nikkei 225 Index dropped 12.4%; the Stoxx Europe 600 Index dropped 2.8%; and S&P 500 micro futures dropped 2.9%.

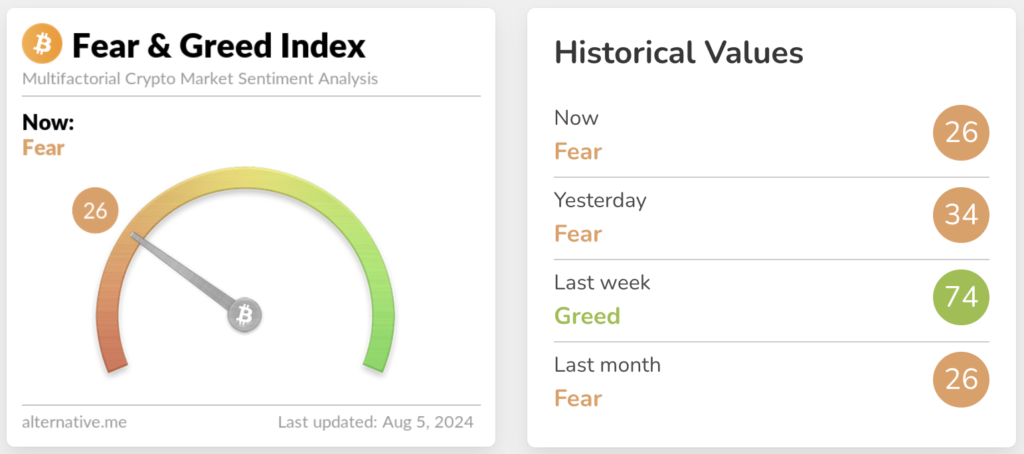

Market Mood Turns Terrified

Tracking volatility, pricing, social media data, the crypto fear and greed sentiment index revealed “fear,” lowest level since early July. Usually indicating local bottoms, this index helps determine whether market players are greedy, marking market tops, or terrified.

Affect on Futures Traded in cryptocurrencies

Over $1 billion in liquidations in crypto-traded futures during the past 24 hours. Stronger Japanese yen and rumors of Jump Trading’s crypto business liquidation aggravated the market sell-off. While Bitcoin futures lead with $420 million, Ether futures recorded over $340 million in liquidated bets. Futures tracking Solana’s SOL, Dogecoin (DOGE), XRP, and Pepe (PEPE) saw $75 million in cumulative liquidations.

————

Massive Trader Losses and Liquidations

With the biggest single liquidation order on crypto exchange Huobi—a BTC/USD trade valued $27 million—more than 275,000 individual traders were liquidated. According to data, 87% of all the impacted traders were long traders hoping for higher prices. While Ether sank as much as 25% before a minor comeback, Bitcoin fell more than 11% in the past 24 hours.

— —

Reasons for Liquidations

Liquidations result from a partial or complete loss of the trader’s initial margin causing an exchange to forcefully close a leveraged position. This happens when a trader lacks enough money to keep the trade open and fails the margin requirements for a leveraged position.

————

More general Market Context

Last week’s geopolitical concerns in the Middle East and unsatisfactory results from technology companies started crypto markets to sell off. These elements caused a flight from dangerous assets and reduced investor excitement about artificial intelligence (AI). Early Monday, the rout got worse as the Bank of Japan’s expectations of more rate hikes drove the yen to seven-month highs and carry trade unwinding caused havoc. The Topix 100 index from Tokyo dropped the most since 2011.

————

Future View

The crypto market looks difficult ahead since most of the losses over the weekend need support from an increase in spot and derivatives activity from conventional financial institutions. “Bitcoin has entered the CME Gap, but technically, it can only be filled during TradFi trading hours,” observed co-founder of trading resource Material Indicators Keith Alan.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment