Table of Contents

Introduction: Partial Victory of Ripple and Looming Appeal Deadline

In the continuous legal fight with the U.S. Securities and Exchange Commission (SEC), ripple and its bitcoin XRP have had a modest comeback. The case is far from finished, though, and as the deadline for the SEC’s appeal gets closer, hostilities are growing. Investors and the crypto community are closely observing since a protracted legal battle seems likely. The stakes are high, thus the result of this lawsuit might have long-lasting effects on the whole bitcoin market.

Notes Regarding the Next Movement of the SEC

Recently, attorney Jeremy Hogan speculated on social media that the SEC might still be unsure on whether to appeal the Ripple lawsuit. Hogan claims that submitting a Notice of Appeal is an easy process requiring just a few minutes. The SEC would then have seventy days to submit a more thorough brief, though. Hogan thinks that if the SEC had already decided to appeal, they would not postpone the submission given the public profile of the matter. The present decision, which is not in the advantage of the SEC, has generated uncertainty in the regulatory scene concerning cryptocurrencies.

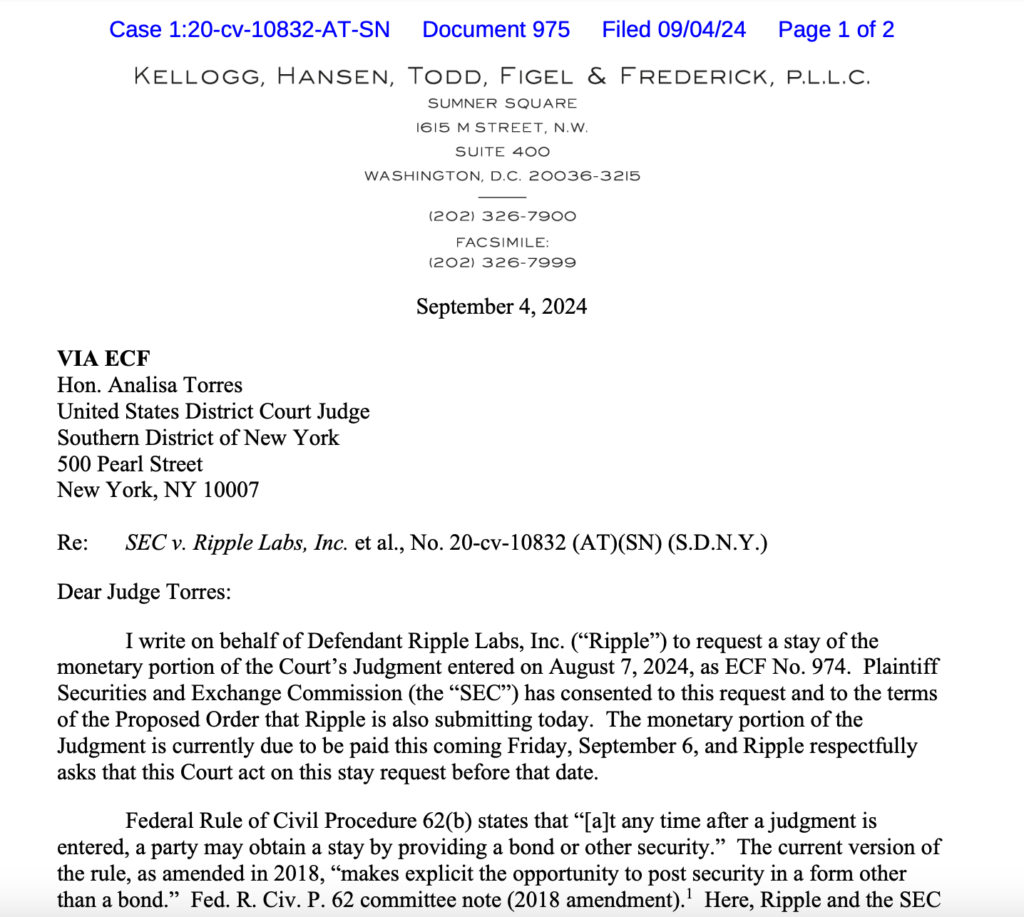

Ripple and SEC ask a stay on monetary judgement.

Recent developments include Ripple and the SEC jointly asking a stay on the $125 million monetary component of the court’s decision. Made just days before Ripple was obliged to pay the penalty, this request was made under order from Judge Analisa Torres September 6. Although Ripple had earlier said it did not intend to appeal, this request for a stay points to the company might be changing its legal approach. Should the stay be approved, the payment will be postponed, allowing the SEC and Ripple more time to get ready for an expected appeal.

Cross-Appeal Possibilities and Tactical Approaches

Former SEC lawyers James Farrell and Marc Fagel have voiced hope that the agency might appeal before the 60-day deadline, which falls early October. If Ripple questions other facets of the court’s decision, it may seek a cross-appeal. Should Ripple decide not to cross-appeal, though, it could find itself paying the $125 million penalty without more argument. With a cross-appeal, Ripple could challenge the decision more holistically, maybe influencing future rules on cryptocurrencies.

XRP Variations in Price Among Legal Uncertainty

The price of XRP has clearly changed in response to the Ripple lawsuit; the cryptocurrency only saw a small 2% rise after the stay demand was revealed. With XRP’s price at $0.562, trading volume jumped 36% suggesting increasing investor interest. At $0.565, XRP encounters critical opposition, thus failing to maintain this level might cause value to decline. Analysts warn that XRP might drop even more if the bearish momentum keeps on, maybe reaching lows of $0.47.

Why the SEC’s Appeal Decision Matters

A pivotal turning point in this legal fight is the SEC’s choice on whether or not to seek a Notice of Appeal. Should the SEC decide to appeal, the lawsuit may drag on and the XRP community and investors would remain in flux. Conversely, should the SEC choose not to appeal, this legal drama could come to an end and Ripple could be free to advance. The result of this case will greatly affect the direction of U.S. bitcoin rules.

Ripple’s Strategic Approach: Balancing a Cross-Appeal’s Benefits and Drawbacks

Legal staff of Ripple must decide whether to accept the court’s decision as it stands or cross-appeal it. A cross-appeal might let Ripple contest more facets of the court’s ruling, so changing the environment for cryptocurrencies in terms of rules. But it also comes with hazards since a protracted legal fight might cause market uncertainty, so influencing XRP’s price and investor mood. As they decide what to do next, ripple’s leadership has to give these elements great thought.

Potential Market Reactions: What stands to be lost for the SEC and Ripple?

The legal fight has stakes much beyond Ripple and the SEC. Particularly for tokens under close examination by authorities, a protracted court case could cast a shadow of doubt over the larger cryptocurrency market. The result of this case is under great observation by investors since it might set a standard for American regulation of cryptocurrencies. Should Ripple’s legal defense be successful, it would open the path for more acceptance and credibility for cryptocurrencies such as XRP.

The wider influence on the crypto market

Legal dispute between Ripple with the SEC is only one among several events that might have major consequences for the bitcoin sector. The result of this case might influence not only XRP but also other digital assets under regulatory observation. While an unfavorable ruling could result in more government enforcement across the sector, a favorable ruling for Ripple could motivate more businesses to question regulatory actions. The course of U.S. cryptocurrency regulation will be much influenced over the next few weeks.

XRP: Important Levels to Track Market Performance

XRP traders are closely observing important pricing levels as the legal conflict plays out. Should XRP be able to surpass the $0.57 resistance level, a more positive trend could be set off, so maybe driving the price higher. On the other hand, neglect of important support levels may cause a marked drop. Investors should monitor closely the legal changes as well as the market performance in the next weeks.

Conclusion: The High-Stakes Future of Ripple and XRP

The legal dispute between Ripple and the SEC is far from finished, thus the next few weeks will be vital to decide the result. The XRP community is keenly waiting for the next action as Ripple considers its choices for a cross-appeal and the deadline for the appeal of the SEC approaches approaches. The outcome of this case will affect the price of XRP, the larger bitcoin market, and the direction of digital asset regulations going forward. Investors should be ready for possible volatility and keep close attention to changes in this high-stakes legal dispute.

Ripple’s road forward: negotiating market uncertainty and regulatory challenges

Ripple must stay committed to its long-term objectives even as it negotiates this convoluted legal terrain and adjusts to short-term market demands. The choices the company makes in the next weeks will not only determine its financial situation but also establish a standard for the whole bitcoin sector. Whether by an appeal, a cross-appeal, or a settlement, Ripple’s approach will be crucial in determining the course of digital assets in the United States and abroad.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment