Table of Contents

Introduction

Particularly if the U.S. economy can avoid a recession, Bitcoin’s possibility to reach new all-time highs later this year is attracting a lot of attention. After a period of market stabilization marked by notable declines between August 2 and August 5, Grayscale Research offers an optimistic projection. We investigate Grayscale’s forecasts, examine the wider ramifications for the bitcoin market, and discuss the salient events surrounding Bitcoin’s recent performance in this paper.

Grayscale’s Bullish Bitcoin Viewpoint

Bitcoin’s road to recovery

The August 8 research report from Grayscale shows hope about the possibility of a “soft landing” for the U.S. economy, so opening the path for Bitcoin to review its all-time high. Unlike past market cycles, the company emphasizes that changes in the U.S. political scene about the crypto sector could lower the negative impacts on valuations. Grayscale says that thanks to consistent demand from recently listed U.S. exchange-traded products and the subdued performance of altcoins, even in a weaker economic environment the possibility for major losses may be more limited.

Macroeconomic Elements Under Action

Looking ahead, Grayscale underlines that central bank actions and future macroeconomic data will mostly determine the stability of the market. Important events including the Jackson Hole Symposium and the Federal Reserve’s meeting in September are expected to be fundamental in guiding the direction of the market. Grayscale keeps a positive view on Bitcoin’s long-term investment potential despite the uncertainty, implying that even an economic downturn could support Bitcoin’s case especially in view of continuous issues about “undisciplined” monetary and fiscal policies.

Current Market Movements: Bitcoin against Ethereum

Effect of the U.S. Employment Report

A dismal U.S. employment report for July, which showed an increase in unemployment—a trend usually seen in past recessions—was mostly responsible for the recent market decline. This caused a sell-off in cyclical assets like stocks while safe havens like the Japanese Yen and U.S. Treasury bonds acquired popularity. Though both Bitcoin and Ethereum fell, Bitcoin showed relative strength while Ethereum underperformed.

Ethereum’s Underperformance

The unwinding of heavy long positions in perpetual futures, which had been accumulated in expectation of the SEC’s approval of spot Ethereum ETPs in May 2024, most likely caused Ethereum’s bigger drop. Ethereum’s price fell faster as these positions were partially sold during the crisis. Large holders of Jump Crypto and Paradigm could also have helped to cause the sell-off, so underlining Ethereum’s price pressure. Ethereum is trading at $2,634.10 right now, down 16.5% over the past week; Bitcoin is trading at $60,001, down 5% as it heals from a brief dip below $50,000.

Resilience of Bitcoin and Market Attitudes

The Price Explosion of Bitcoin

After a larger market rally reversing significant losses from previous Friday, Bitcoin momentarily surged above $62,000 before declining during Asian morning hours. With some market watchers reviewing their $100,000 year-end target for Bitcoin, this recovery has sparked positive attitude once more. On Thursday, U.S. markets also rallied; the S&P 500 had its best day since November 2022 and the tech-heavy Nasdaq 100 surged 3.1%.

Liquidations and Market Dynamics

With a 7.2% increase over the past 24 hours, Bitcoin’s short liquidations almost equal $100 million, among the biggest hits for bearish investments on the currency this year. Market watchers credit these increases on positive stock market mood and hopes that Bitcoin would follow past market trends. With the Bank of Japan showing no more interest rate hikes and Jump Trading maybe running out of coins to sell, Michael Terpin, founder of Transform Ventures, pointed out that Bitcoin’s price might not drop much below $50,000 again, if at all.

Market Indicators: Analyst Opinues and Positive Signals

Bull-Bear Market Cycle Indicator

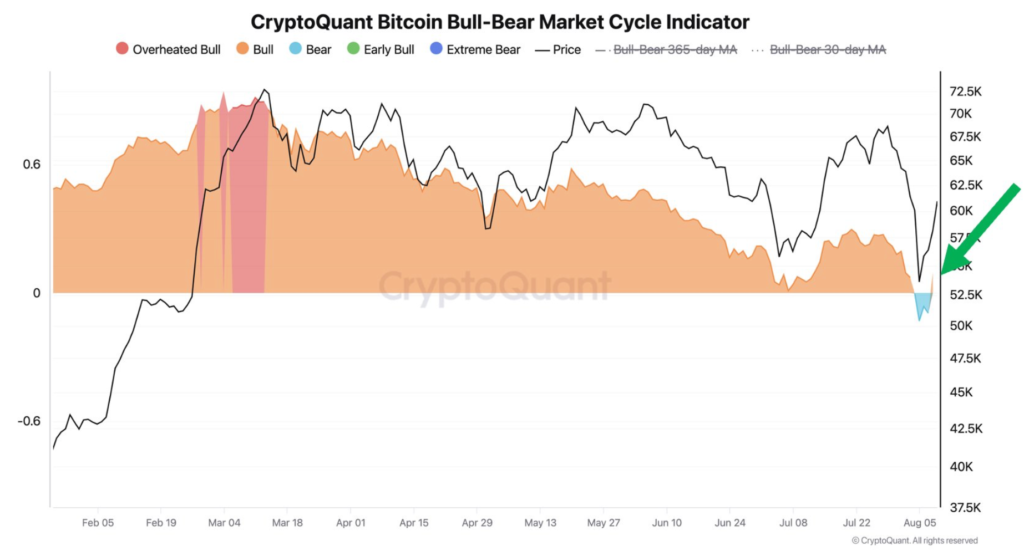

After three days of flashing red, which dropped Bitcoin’s price to levels not seen since February, the Bitcoin bull-bear market cycle indicator—which tracks investor sentiment phases—flipped to signal bullish conditions. Most of the Bitcoin on-chain cyclical indicators hovering near the borderline have now turned back to indicate a bull market, according to cryptoQuant founder Ki Young Ju.

Divergent Analyst Opinions

Some analysts are more cautious even if some believe that the current decline of Bitcoin reflects past trends before bull runs. Head of research Markus Thielen of 10x Research proposed on August 7 that Bitcoin prices might have to drop into the low $40,000s in order to ideally time the next bull market entry. Comparably, according to an August 6 report by Cathie Wood’s investment company Ark Invest, Bitcoin’s most significant price supports fall at $52,000 and $46,000. Veteran trader Peter Brandt observed that the fall in Bitcoin since the halving now resembles that of the 2015–2017 halved bull market cycle, implying that a bull run might follow.

Conclusion

Recent price swings of Bitcoin and the larger market dynamics show a complicated interaction of macroeconomic elements, investor mood, and market cycles. Although Grayscale’s positive view gives hope, the road forward is still unknown since important events that could influence the direction of the market are on store. Investors will have to be alert and informed as Bitcoin negotiates these obstacles, prepared to change with the terrain.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment