Table of Contents

Introduction: Present Status of Altcoin Season

Though positive signs, the much awaited altcoin season has not materialized. Though spot Ethereum ETFs have lately been approved, the expected rise in altcoin prices has not materialized since the market has shown minimal reaction. This begs questions about the possibility of a quick significant rise in altcoin values.

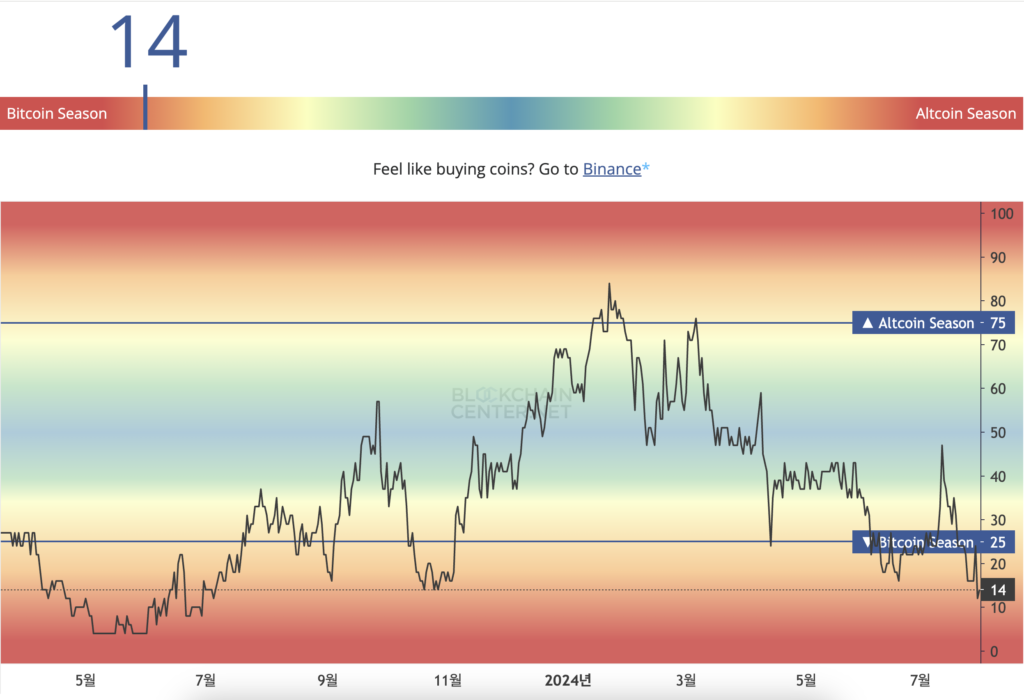

Altcoin Season Index: Tracking the Trends

The Altcoins Season Index—which gauges the performance of cryptocurrencies other than Bitcoin—has lately been disappointing. At 18, the current index is much below the necessary level of 75 to confirm the occurrence of altcoins season. This implies that hardly a minority of altcoins are outperforming Bitcoin. Like past June and November 2023 trends, the lack of development suggests that altcoins are struggling to acquire momentum in comparison to Bitcoin, which lately exceeded the $70,000 mark.

Investor Interest and Market Mood:

One can somewhat blame declining investor excitement for the lack of a significant rise in alternative cryptocurrencies. The demand for alternative cryptocurrencies declines as the degree of excitement lowers, so preventing any price increase or even declining. Lack of momentum calls questions about the long-term survival of an altcoin season. Still, some players in the market keep a good attitude. One of Magnify Labs’ co-founders, Ty Blackard, thinks there might be an altcoin season especially if Ethereum rises above its past highest value.

Evaluation of Ethereum’s Importance in the Altcoin Market

Many times considered as a predictor or indicator of the altcoin market is Ethereum. Blackard says the market might move into a phase marked by the predominance of gas tokens and altcoins once Ethereum exceeds its past highs. This change could cause focus to be diverted from memecoins toward tokens with better utility and strong fundamental values. Still, a look at market capitalization measures (TOTAL2 and TOTAL3) suggests that the altcoin season might not depend just on Ethereum’s performance. Comparable trends are shown by TOTAL2, which excludes Bitcoin, and TOTAL3, which excludes Ethereum as well as Bitcoin. This implies that although Ethereum has a big influence, the price of the coin by itself does not define whether an altcoin season occurs.

Projected Outlook: Altcoin Predictions

Notwithstanding the challenges, there is still possibility for an altcoin season especially if money is moved from Bitcoin to the altcoin sector. Should this flood of money materialize, it could raise altcoin values and maybe start a market surge all around. As these elements could significantly affect the altcoin scene, investors should closely follow market developments including the performance of Ethereum and the general attitude of the market.

Conclusion: Is a phase of more altcoin activity about to arrive?

While the current statistics does not offer clear proof of an approaching altcoin season, it is noteworthy that the market is quite erratic and can undergo quick conditions change. Crucially, one will be tracking the relevance of Ethereum, investor mood, and capital movements. Before deciding what to invest in, investors should constantly be well-informed and carefully go over thorough research.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment