Table of Contents

The daily net inflows into spot Ether exchange-traded funds in the United States have once again turned positive, despite the fact that the cumulative outflows from Grayscale’s Ethereum Trust have exceeded $2 billion.

Inflows into Ether ETFs

The significant inflow of $91.4 million into BlackRock’s iShares Ethereum Trust (ETHA) was the primary driver of the net inflow of $28.5 million that was experienced by Ether exchange-traded funds (ETFs) on August 1. On the other hand, Grayscale’s Ethereum Trust experienced withdrawals of $78 million on the same day, bringing the total amount of money that has been taken out of the fund due to its conversion into a spot fund to slightly more than $2 billion.

Grayscale’s Ethereum Trust Outflows

In the beginning, Grayscale’s Ethereum Trust was a trust that offered institutional investors exposure to Ethereum (ETH). On July 23, the trust was converted into a spot exchange-traded fund (ETF). A total of nine billion dollars’ worth of Ether was held by the trust prior to this conversion. It appears from the most recent outflows that twenty-two percent of the initial fund has been sold.

Market Impact and Predictions

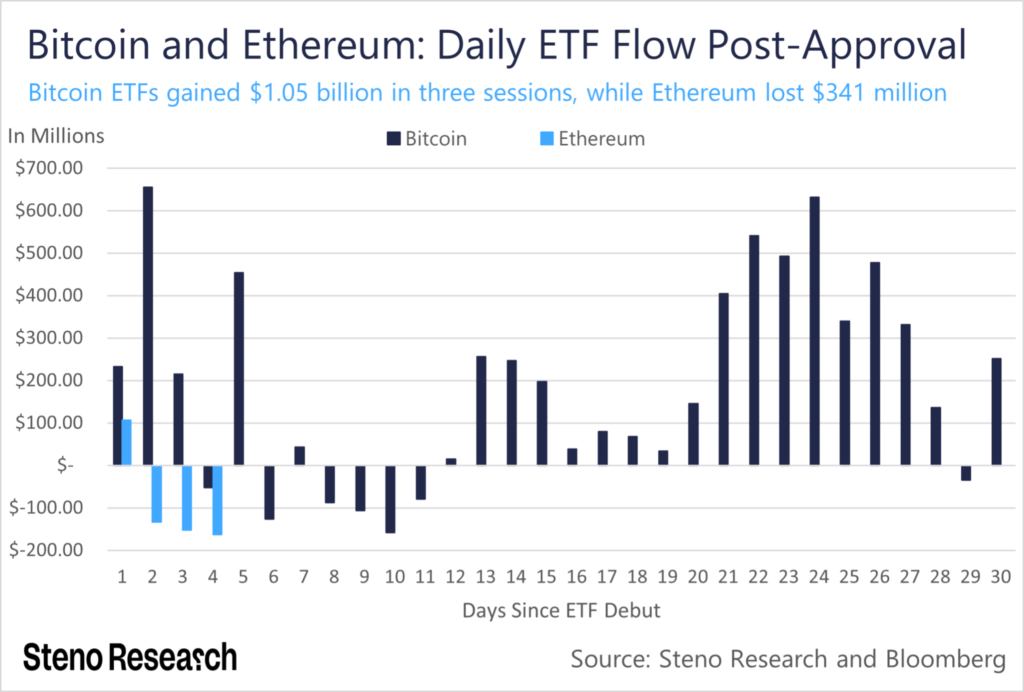

There are a number of analysts who believe that the slowing outflows from Grayscale’s Ethereum Trust could be an indication that the price of Ether is about to undergo a significant change. According to Mads Eberhardt, a senior analyst at Steno Research, it is “likely” that the massive outflows from Grayscale’s ETHE will begin to subside by the end of the week. This could potentially serve as a bullish catalyst for the price of Ethereum.

In an article that was published on X on July 30th, Eberhardt stated, “When it does, it’s only up from there.”

In a similar vein, Will Cai, who is the head of indexes at Kaiko, had previously mentioned that the price of ETH would be “sensitive” to the inflows that were being made into the spot products. This sensitivity was reflected in the fact that Ethereum was trading at $3,168 at the time of publication, having experienced a decline of 8.5% since the launch of the ETFs, as indicated by data from TradingView.

Analyst Insights on Ether’s Future

Ether’s future appears to be bright, as evidenced by the persistent net inflows into Ether exchange-traded funds (ETFs) and the gradual decrease in outflows from Grayscale’s fund portfolio. As the dynamics of the market continue to shift, analysts continue to maintain their optimism that these trends will strengthen the price of ETH, driving it higher.

Conclusion

Significant market movements can be inferred from the recent trends in Ethereum exchange-traded funds (ETFs) and Grayscale’s Ethereum Trust. There is a growing likelihood that a bullish run for Ethereum will occur as the outflows from Grayscale’s fund begin to slow down and as the inflows into Ether exchange-traded funds (ETFs) increase. Those who invest are keeping a close eye on these developments, hoping that they will result in favorable price movements in the not too distant future.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment