Table of Contents

Bitcoin’s Price Decline Post Wall Street Opening

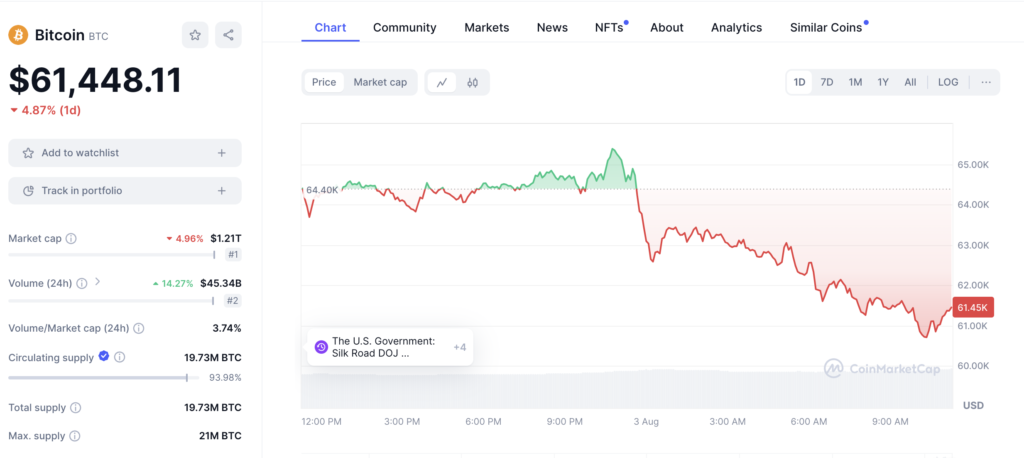

After Wall Street opened on August 2, Bitcoin’s price fell by $2,300 one hour. On Coinbase it came to $62,368. Rising 1% over the past 24 hours to $63,252, this sell-off resulted in key support levels lost for Bitcoin: the 50-day exponential moving average (EMA) at $64,300 and the 100-day EMA at $63,670.

Market Analysts React

Since July 30, Bitcoin analyst AlphaBTC observed notable price movement as Bitcoin dropped from $66,996 to slightly below $63,000 on August 2. AlphaBTC underlined the need of maintaining the range low at $63,300 to raise the possibility of retesting the range high at $67,000. Both AlphaBTC and Crypto Rover say losing the $63k support would be negative.

Bullish and Bearish Scenarios

AlphaBTC presented two possible scenarios: a bearish case whereby Bitcoin breaks down the support at $63,000, lowering the price to $61,000; a bullish case whereby Bitcoin confirms a triple bottom structure around the 38.2 Fib level at $63,450, so guiding a V-shaped recovery towards $66,800. While other analysts projected deeper corrections, AlphaBTC set a short-term bearish target at $61,000. Targets range from $58,000 to $55,000.

Technical Indicators and Support Levels

Keeping above the rising trendline, Bitcoin’s price action has created a sequence of higher lows on the daily chart. To stop more losses, bitcoin enthusiasts must keep the price above this point. The look of a long lower wick on the August 1 candlestick suggested to buyers the significance of the $65,000 level. Losing this support might cause Bitcoin to withdraw toward the 200-day EMA, considered as its last line of defense at $59,558.

Analyst Predictions and Investor Sentiment

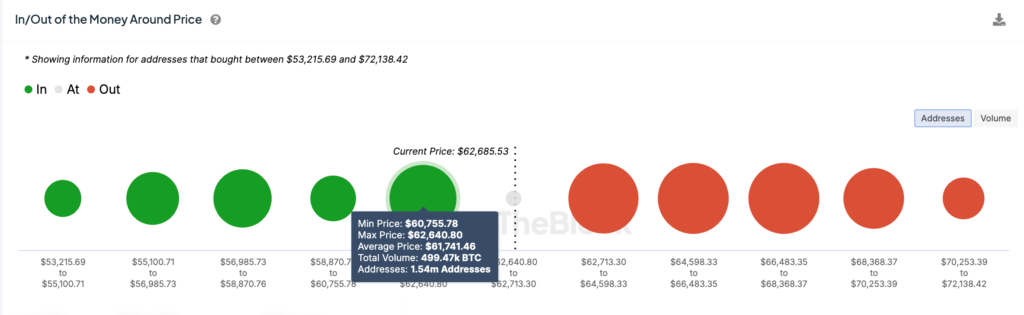

Analyst Caleb Frazen agreed with the relevance of the 200-day EMA as a major obstacle for Bitcoin based on investor sentiment. Data from IntoThe Block’s In/Out of the Money Around Price (IOMAP) model confirmed the relevance of this level by implying that strong demand-side liquidity from this cohort of investors could push Bitcoin’s price past the resistance levels given by the 100- and 50-day EMAs at $63,663 and $64,268, respectively, so ending the sell-off and starting a price recovery.

On the 15-minute chart, popular analyst Moustache noted that Bitcoin’s price was creating an inverse head-and-shoulders pattern, implying a trend reversal to the upward. Before maybe retesting to the range high of $65,300, this pattern suggests that Bitcoin’s price could start a notable upward breakout towards its next key price level of $65,000.

Market Volatility and Broader Impact

Along with a significant decline in equity markets, Bitcoin’s attempt at a meager early rally during U.S. trading hours fell 4% in roughly ninety minutes. Typically a good indication for risk assets like stocks and Bitcoin, a weak July U.S. jobs report sent bond yields and the dollar declining. But this was not the case; led by an 11% post-earnings drop in Amazon and a 5% drop in Nvidia, the Nasdaq dropped 3.1% and the S&P 500 dropped 2.7%. The Volatility Index (VIX) jumped 54%.

At one point Bitcoin barely gained a little bit above $65,000; but, it fell back to $62,900 in response to the risk-off atmosphere. Off almost 3%, the more general Coin Desk 20 Index suffered. Leading the way lower were ether (ETH), solana (SOL), uniswap (UNI), chainlink (LINK), each with declines of 4%-5%.

Global Market Reactions

A continuous plunge in Japan, where the Nikkei dropped 5.8% on Friday following a 4%+ drop the day before, also affected the dour attitude in the market. The selloff seemed to be in response to modest monetary tightening actions by the Bank of Japan, which raised its benchmark lending rate from a previous range of 0%-0.1% to 0.25%.

Conclusion

The present market volatility of Bitcoin emphasizes the need of technical indicators and important supporting levels. Regarding the short-term future, analysts are still split; some see a notable upward breakout while others predict more profound corrections. To negotiate the continuous uncertainty in the crypto market, investors should attentively track market trends and important supporting levels.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment