Table of Contents

Institutional Adoption and Potential Bitcoin Surge

Should financial institutions keep including cryptocurrencies into their business processes, the value of one Bitcoin could rise to $700,000. Renowned Bitcoin analyst Willy Woo has issued this bold forecast. He says this notable price appreciation could come from a three percent portfolio allocation in Bitcoin. The results of Woo’s research indicate that a major influence on the price rise of Bitcoin could be its growing attraction to institutional investors, who are injecting large capital into the market.

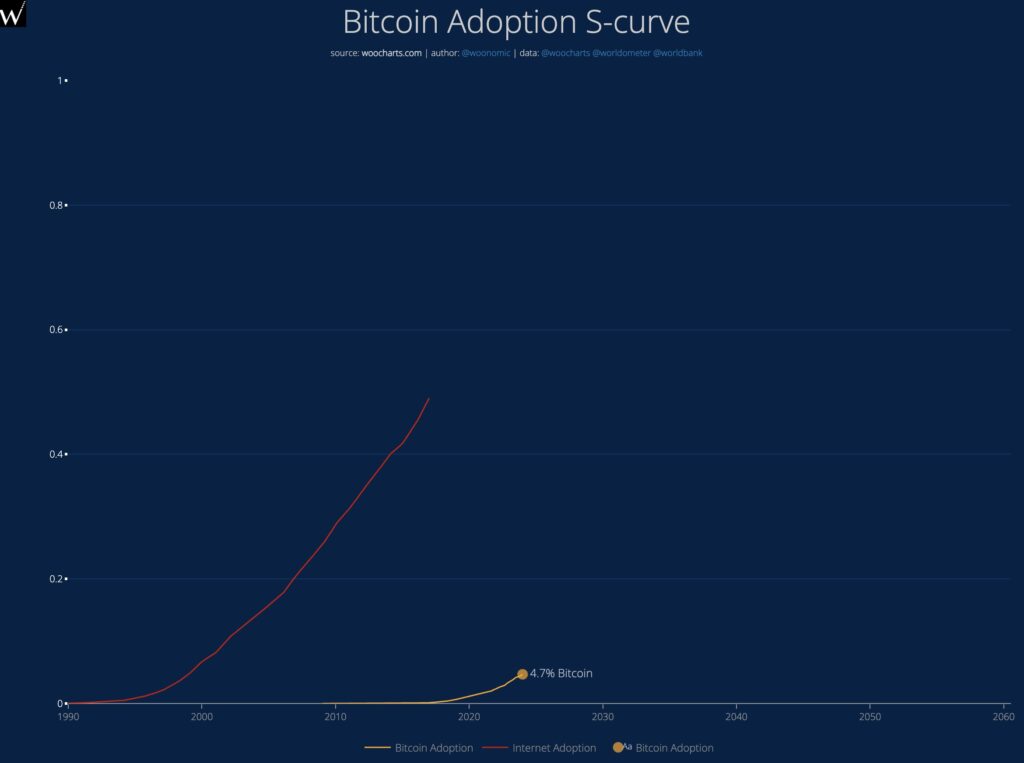

Understanding the Adoption Curve

Woo bases his projection on the estimated annual total value of wealth assets worldwide, more than $500 trillion. According to him, Bitcoin’s adoption curve has to be able to surpass the 16% threshold if it is to attain this “ultimate price.” Right now, the Bitcoin cryptocurrency is followed by almost 4.7% of the global population overall. Woo, on the other hand, believes that if Bitcoin’s acceptance follows the path of the internet, which underwent fast expansion following the first 15 years of existence, this rate may considerably rise.

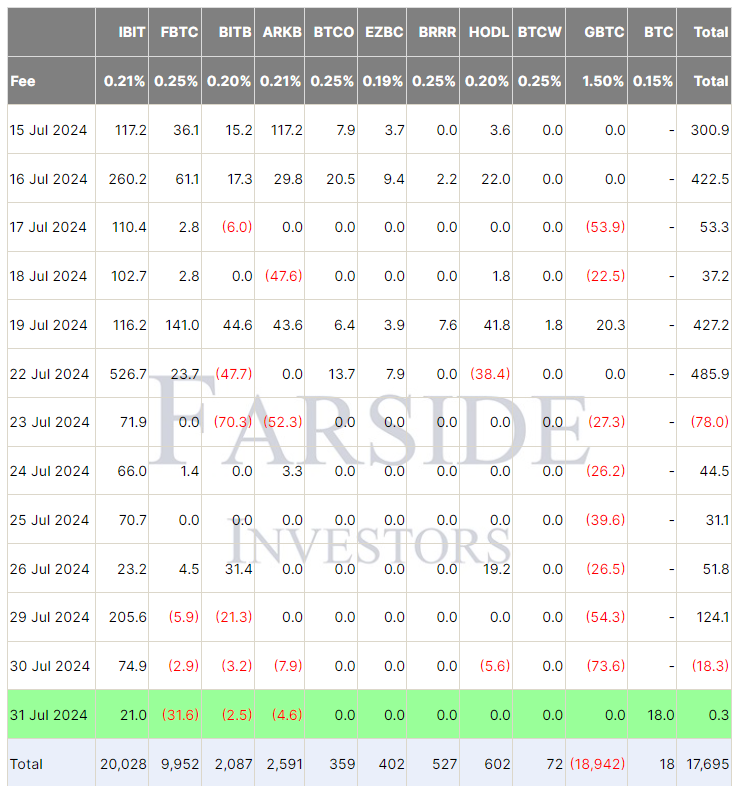

Current Bitcoin Price and Market Dynamics

Notwithstanding the positive projection, the price of Bitcoin is still 12% lower than its all-time high of $73,750, attained on March 14. Data from Bitstamp shows that the price of Bitcoin as of the first of August is roughly $64,465. One of the reasons Bitcoin has had trouble gathering momentum is the slowing down of U.S. spot Bitcoin exchange-traded funds inflows. Farside Investors claims that on July 31, these exchange-traded funds (ETFs) just amassed $300,000 worth of Bitcoin, a notable decline from the net outflows of $18.3 million the day before.

Impact of ETF Inflows on Bitcoin Price

Rising bitcoin prices have historically been mostly attributed to flows into exchange-traded funds (ETFs). Exchange-traded funds (ETFs) accounted for almost 75% of the fresh investment in Bitcoin at the middle of February, which drove its price above $50,000 mark. The recent slowing down in ETF inflows is one of the elements influencing Bitcoin’s price action staying unaltered. Conversely, the fact that, as of the 24th of July, more than seventy-five percent of Bitcoin’s short-term holders were profitable suggests the possibility of increasing momentum. This statistic is widely used to assess the demand for Bitcoin among retail investors, implying that these people might keep supporting the market.

Conclusion: The Future of Bitcoin’s Price

Though the estimate that Bitcoin will reach $700,000 is high, it is not entirely out of reach, especially considering the rising acceptance of the coin by organizations. As more retail investors and financial institutions start using Bitcoin, the adoption curve might get steeper and the price of the coin might rise. Investors should closely monitor the flows of exchange-traded funds (ETFs) along with other market indicators to better grasp the possibility for future price movements.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment