Table of Contents

Introduction

Recent notable losses on both Bitcoin and Ether have led to volatility in the bitcoin market. This drop in digital assets, which occurred in the middle of world market volatility, sparked questions and discussions on their future.

The Steep Decline and Partial Recovery

For the bitcoin market, the major turning point came when the price dropped significantly below $50,000. Ether’s price also dropped sharply, falling to levels not seen since the fall of FTX in 2022. Despite all they went through, these two cryptocurrencies showed indications of durability. The fact that Bitcoin recovered to more than $56,000 and Ether recovered to $2,500 shows the volatility of the market and the possibility of fast rebounds.

Market Conditions Impact

Particularly following the launch of spot Bitcoin and Ether exchange-traded funds (ETFs) on the United States market, the present economic crisis acted as a major stress test for digital assets. Ether exchange-traded funds were able to offset outflows by drawing net inflows of $49 million, which would help them. Conversely, Bitcoin exchange-traded funds (ETFs) suffered notable outflows; Monday alone saw $168 million lost.

Market Sentiment and Predictions

Though there has been some partial recovery, the attitude of the market remains cautious. One of the highest records from the start of March—the total amount of money sold off of bitcoin bets came to about $1.1 billion. Nonetheless, some traders still have hope for a quick turn around. Just nine days ago, Rich Rosenblum, co-chief executive officer of GSR Markets, noted that the Bitcoin community was feeling rather upbeat. He proposed that in the same period of time Bitcoin dropped, it could bounce back to $70,000.

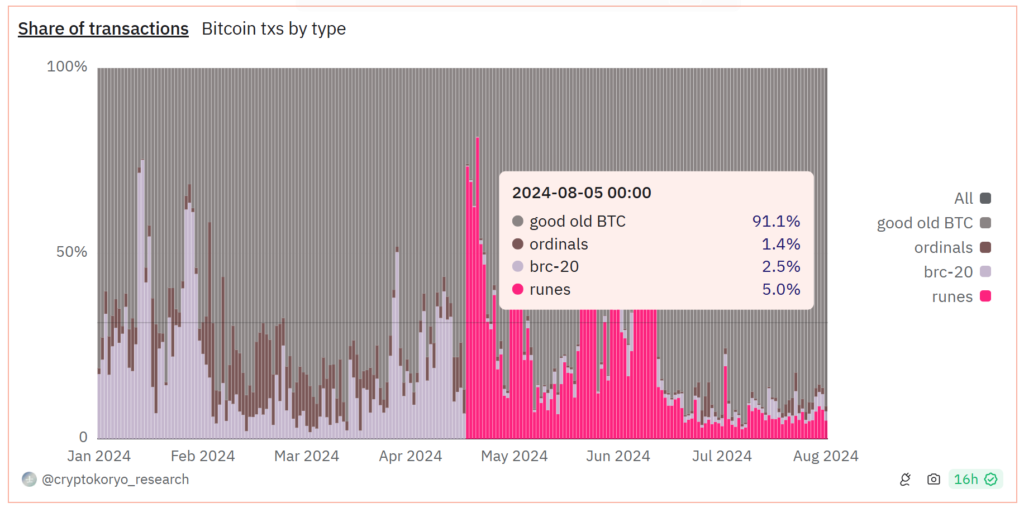

Surge in Bitcoin Transactions

The volume of Bitcoin transactions on cryptocurrency exchanges peaked in the middle of the market, the first time since the fourth Bitcoin halved that this has happened. Regarding the United States Dollar, the overall trading volume on significant Bitcoin exchanges increased on August 6 above $1.14 billion. Driving forces behind this increase in activity were both investors seeking to reduce their losses and those grabbing the chance to buy Bitcoin at a discounted price.

Hacker Activity During the Crash

The sudden decline in price allowed cryptocurrency hackers to seize the chance to buy Ether at a notable discount with money they had pilfers. Based on a blockchain analytics company Lookonchain report, hackers moved large sums of Ether to Tornado Cash during the crash. This emphasizes the opportunistic behavior found in the realm of cryptocurrencies.

Conclusion

Recent performance of cryptocurrencies including Bitcoin and Ether emphasizes the natural volatility of the market for them. Although some traders see the dip as a buying chance, others are still wary about the prospect of more losses. The state of the economy as a whole, investor attitude, and the ability of digital assets to show resilience against uncertainty will all greatly affect the direction of the market. Investors who want to effectively negotiate these stormy times must keep informed and alert since the bitcoin market is always changing.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment