Table of Contents

Introduction: Place of Bitcoin in the Financial Market

Leading cryptocurrency Bitcoin is under constant examination by investors and analysts. Given its special place in the global market, the price swings of Bitcoin sometimes mirror more general economic mood. This paper explores the recent behavior of Bitcoin in particular its attempt to break out from its price range and the elements driving these movements. By the time this article ends, you will have a complete awareness of the market behavior of Bitcoin and know what to expect in the next weeks.

recent performance and price movements of Bitcoin

Rising over 2.5% and almost reaching the $61,000 level, Bitcoin has been showing indications of recovery. Investors and traders who hope Bitcoin would break out from its inflexible price range have found hope in this recent price increase Market data from Cointelegraph Markets Pro and TradingView shows how Bitcoin reached local highs of $61,424 on Bitstamp, so reflecting a positive attitude in the market.

This price movement shows that Bitcoin is trying to surpass past resistance levels, unlike the week’s previous tendencies. Analysts are closely tracking these trends and pointing out that recent price movement of Bitcoin could be caused by more general macroeconomic elements including corporate buybacks and risk-on attitude.

Macro Sentiments’ Effects on Bitcoin

The price of Bitcoin is rising not in a vacuum. Analysts from QCP Capital have observed that Bitcoin’s rising trajectory may be influenced by the recent equity rally driven by corporate share buybacks totalling $1.15 trillion? Goldman Sachs has also recorded unprecedented client demand during market declines, so reflecting a change in risk-on attitude.

This rising hope transcends stocks as well. The relationship between Bitcoin and other assets such as gold, which lately reached an all-time high, points to investors looking for other investments in view of uncertain economic conditions. Market players are speculating on possible relaxation of U.S. financial policies as the annual Jackson Hole symposium of the Federal Reserve draws near, so bolstering the surge in Bitcoin.

Knowledge of Bitcoin’s Present Range

Though recently rising, Bitcoin’s price is still caught in a downward-sloping range and finds difficulty breaking the key resistance level close to $70,000. Popular traders like Mark Cullen have emphasized Bitcoin’s attempt to hold the $60,000 level; some predict the price to test the liquidity levels above early August highs in the mid-$60,000 range.

Analysts like Rekt Capital point out historical trends that suggest Bitcoin might be trying to recover important support levels. Though the market is still erratic and the price action probably will continue its sideways movement in the near future, thus caution is advised.

The Function of Long-Term Investors in the Stability of Bitcoin

The behavior of long-term holders (LTHs) is one of the main determinant of Bitcoin’s price stability. Recent data indicates that the realized market capitalization of Bitcoin for long-term investors has lately surged by $3 billion, following a December 2023 trend last noted. This increase shows that long-term holders of Bitcoin remain convinced in its value even in spite of transient volatility.

Usually keeping their investments for more than six months, LTHs differ from short-term holders (STHs) who prioritize rapid returns. Although STHs could be selling during market downturn, the recent rise in LTHs’ market capitalization points to these investors acquiring Bitcoin. Understanding the long-term potential of Bitcoin and its capacity to resist transient price swings depend on this behavior.

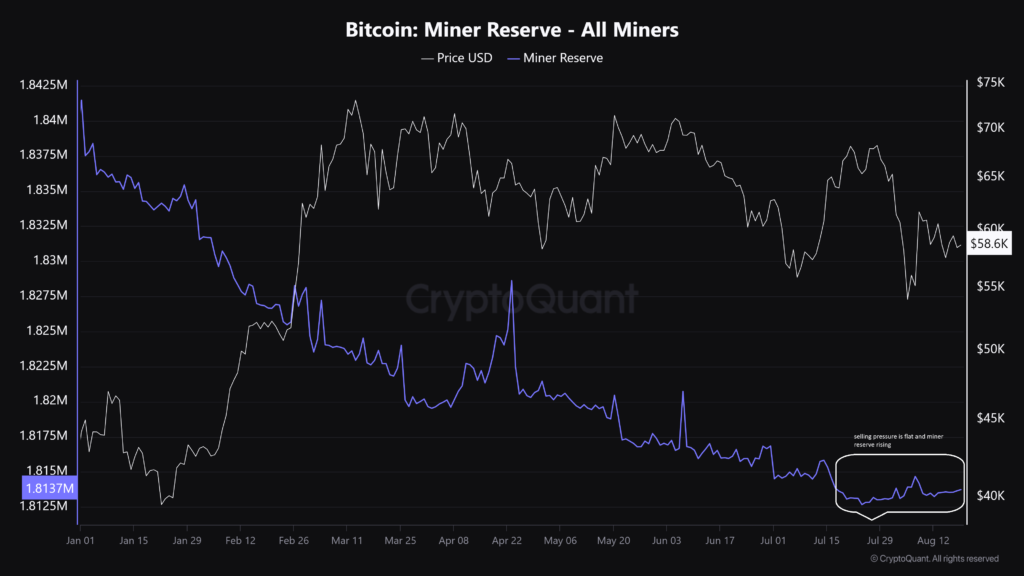

Bitcoin Miner Activity and Consequences

The ecosystem of cryptocurrencies depends much on the activities of bitcoin miners. Minerals’ clearly declining selling pressure lately points to a possible reversal of trends. miners had been selling their BTC holdings in the second quarter of 2024, but with reserves showing indications of accumulation, this trend seems to be stabilizing.

This change in miner behavior may indicate that Bitcoin is almost at a price floor, providing stability before any notable increase. One crucial sign that the market might be getting ready for a more positive phase is the flattening of mining selling pressure.

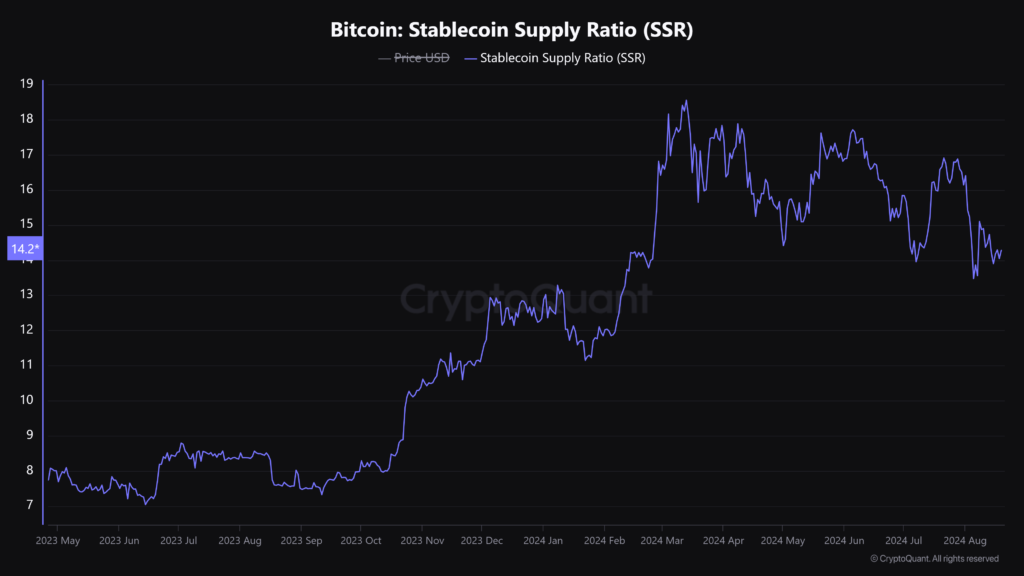

The Stablecoin Supply Ratio and Bullish Signals

Stablecoin Supply Ratio (SSR) is another important indicator pointing possible positive trends for Bitcoin. The SSR gauges the whole crypto market cap in relation to the market cap of all stablecoins. A declining SSR suggests that stablecoins—which can be used to buy Bitcoin—more liquidly are available.

Pointing to an increase in accessible liquidity, the SSR has currently dropped to levels not seen since early February 2024. Head of research at CryptoQuant Julio Moreno claims that the overall stablecoin market cap now stands at $165 billion—a fresh high. For Bitcoin, this rise in liquidity is encouraging since more money will be free for investment in the cryptocurrency market could cause a rally.

Levels of Resistance of Bitcoin and Prospect for a Bullish Breakout

Recent price movement of Bitcoin points to its almost positive breakout. Bitcoin has recovered above $60,000 after closing below the 200-day EMA two weeks running consecutively. This recovery is a clear sign that optimistic momentum is progressively developing.

At the $61,700 level, where a junction of the 50-day and 100-day EMAs is found, Bitcoin encounters notable opposition, though. For Bitcoin to confirm a positive reversal, it will be imperative to overcome this opposition. Should Bitcoin be able to surpass $62,737, a market signal known as “Choose CH” (Change of Character) may be set off, signaling a reversal of trends and maybe resulting in higher price levels in the next weeks.

Conclusion: Future Direction of Bitcoin

The latest price swings and underlying market dynamics of Bitcoin point to the coin as at a turning point. Although the present price range still presents difficulties, encouraging signals from long-term holders, declining selling pressure from miners, and more market liquidity overall.

Investors will be especially keenly observing Bitcoin’s capacity to break out from its present range and overcome important resistance levels as we head toward August’s end. Though it will need consistent momentum and favorable market conditions, there is possibility for a bullish breakout.

Making wise decisions for those who own Bitcoin or are thinking about joining the market depends on knowing the wider economic background and keeping current with these market developments.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment