Table of Contents

Investigating the Current Bitcoin Price Movement

Once more showing signals of recovery after a period of consolidation is Bitcoin (BTC). On August 9, well-known bitcoin trading specialist TradingShot released an interesting Bitcoin price estimate on TradingView. Employing the “Golden Ratio” correlation—a strong signal historically linked to Bitcoin’s parabolic swings—this study aimed to Knowing the consequences of this study and what it could mean for the future of Bitcoin is essential since the market is getting ready for maybe significant movements.

The Golden Ratio Correlation and Historical Significance

Explain the correlation of the “Golden Ratio”.

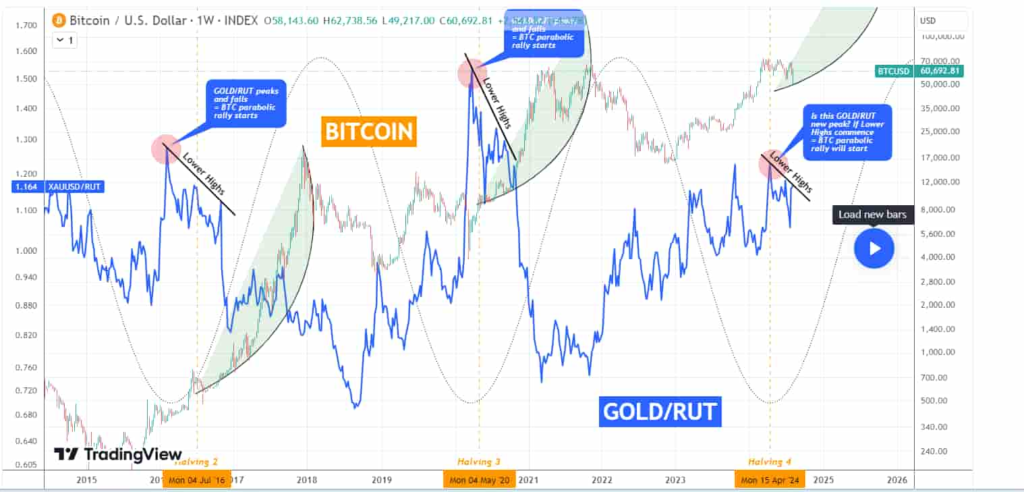

Between Bitcoin and the Gold/Russell 2000 (GOLD/RUT) ratio lies the correlation sometimes referred to as the “Golden Ratio”. Historically, particularly with relation to its parabolic rallies, this relationship has been a reliable guide for Bitcoin’s price movements. Representing small-cap U.S. stocks, the GOLD/RUT ratio analyzes the relationship between the Russell 2000 Index and Gold, a traditional store of value.

Predictive Authority and Historical Trends

Usually, when the GOLD/RUT ratio peaks and subsequently begins to create Lower Highs, Bitcoin follows a parabolic surge. This cyclical pattern suggests that for the price path of Bitcoin, the GOLD/RUT ratio is a leading indicator. For instance, after the 2016 halved, Bitcoin began a notable ascent that produced the 2017 bull market with prices almost at $20,000. Following the 2020 halved, a similar trend emerged whereby Bitcoin’s former all-time high of almost $68,000 in late 2021 developed.

Analyzing the Present Market: Getting ready for a new Bull Run on Bitcoin

Updates in the GOLD/RUT Ratio

As of April 2024, the GOLD/RUT ratio may have peaked, implying Bitcoin’s possible entry into the most forceful phase of her bull cycle. Should the ratio begin to show Lower Highs, as in past cycles, we could be about to see a rapid and dramatic price increase for Bitcoin.

Long-term and short-term cost projections

Given the present dynamics of the market, a reasonable short-term target for Bitcoin could be between $80,000 and $85,000. Slightly above the all-time high of $73,000, this spectrum fits the expected sharp rise during the aggressive phase of the bull cycle. Should the parabolic surge gather noteworthy momentum over time, Bitcoin could perhaps reach $100,000 to $120,000 during this cycle. These projections are based on the historical scale of Bitcoin’s price swings in previous parabolic phases, particularly in respect to halved events.

Analyzing Bitcoin’s volatility: NVT-GC’s contribution in it

Knowledge NVT-GC: A Volatile Gauze

Described by CryptoQuant as a volatility indicator similar to the Bollinger Bands, NVT-GC is yet another indispensable instrument for analyzing Bitcoin market behavior. While NVT compares the market capital of Bitcoin to the value of transactions over a given period, the Golden Cross edition relates long-term and short-term NVT values. This tool provides a basic direction for finding local market tops and bottoms.

Current Signals and Their Effects

NVT-GC generates three main bottom signals for 2024 that are Rising above 2.2 points (red zone), the NVT GC shows short-term price overheating, so indicating a local top. On the other side, it indicates too much cooling and a local bottom if it falls below -1.6 points, the green zone. For example, following the two former bottom signals from January 18 and July 12, BTC price increases of 78% and 23%, respectively. Our current local bottom area based on the NVT GC suggests that a favorable short-term trend could be about to begin.

Support Levels of Bitcoin and Market Opinion

Activity in Present Trading and Main Support Levels

Even if Bitcoin trading over the weekend comes around $60,000, the market is still rather uncertain. Data from Cointelegraph Markets Pro and TradingView confirm that not all traders are convinced that the support level will remain even if Bitcoin has kept appeal during “out of hours” trading.

Potential Market Corrections

While some well-known traders see a possible drop, Crypto Tony advises a possible return to $58,300. Similar comparisons to a year ago when BTC/USD momentarily dropped to $25,000 have been made by blockchain tech enthusiast Elja Boom. Boom’s studies indicate that even a retest of smaller degrees could indicate a total market reversal and consequent comeback.

Conclusion: Preparing for the Next Bitcoin Bull Cycle

By providing perceptive analysis of its possible price swings, the “Golden Ratio” correlation and NVT-GC tools enable Bitcoin negotiate this critical phase. These signals should be especially important for traders and investors since past trends indicate a possibility of a new parabolic surge. Though short-term swings and possible declines are unavoidable, Bitcoin’s long-term future is bright and fresh all-time highs are possible.

For those in the cryptocurrency field, it is essential to understand these signals and prepare for next market swings. As usual, optimizing Bitcoin’s next big action will rely on closely tracking market events and adjusting strategies in line.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment