Table of Contents

Introduction

In a major turn of events, a federal judge has directed Ripple Labs to pay a $125 million civil penalty, so marking another chapter in their long-standing legal conflict with the U.S. Securities and Exchange Commission (SEC). This paper explores the main case events, Ripple’s future prospects, and more general consequences for the bitcoin market.

A Legal Viewpoint: The SEC Against Ripple

The First Complaint and Partisan Triumph

Beginning in December 2020, the SEC sued Ripple for allegedly raising more than $1.3 billion via an unregistered digital asset securities offer. Ripple got a partial win in July 2023 when the court decided that programmatic sales to retail investors did not violate securities laws while only institutional sales of the XRP token broke laws. With 1,278 transactions identified to have violated Section 5 of the Securities Act of 1933, the recent $125 million penalty directly relates to these institutional sales.

Ruling of Judge Torres: Impact

Presiding over the matter, Judge Analisa Torres also granted an injunction stopping Ripple from more securities law violations. This decision especially affects On- Demand Liquidity services of Ripple. The judge denied the SEC’s demand for disgorgement and prejudgment interest, however, citing agency failure to demonstrate “pecuniary damage” sufficient to support such fines. Brad Garlinghouse, CEO of Ripple, hailed the decision as a triumph for both the business and the wider bitcoin sector.

The ripple effect: How the case shapes the market.

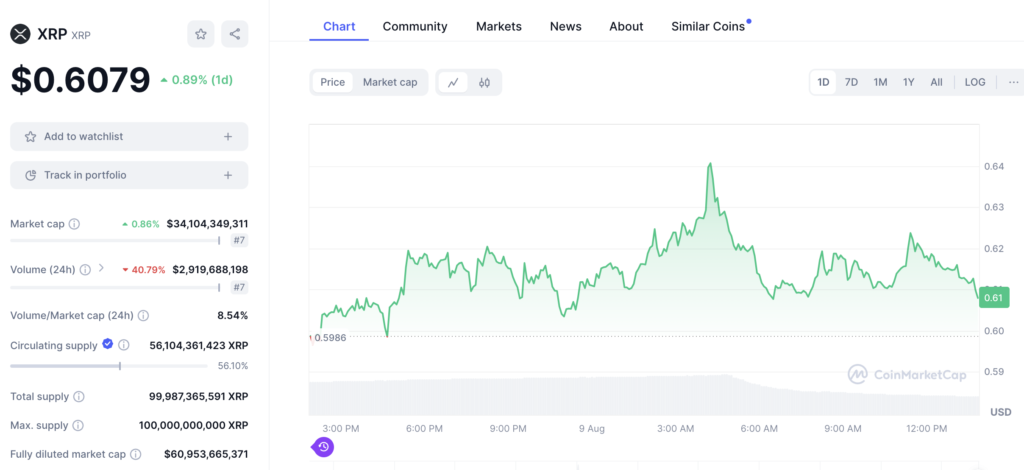

XRP’s Price Increase

XRP saw a notable price rise after the $125 million penalty was announced, rising almost thirty percent from daily low. This increase in trading activity, especially in markets like South Korea where expectations of a positive outcome for ripple have driven interest, reflects Still up for debate, though, are more general ramifications for Ripple’s company, particularly should the SEC choose to appeal the decision.

Future Prospects and Market Reactions

The case is far from over even with the favorable reaction of the market. Legal professionals advise the SEC to probably appeal the decision, so prolonging the legal struggle for years. Ripple has already expanded its activities outside of the United States, so reducing some of the negative impacts should more limitations be placed on its American activities. Still, the company’s future is shadowsed by the continuous litigation.

The wider picture: consequences for the bitcoin sector

Bellwether Case for the Sector

Considered as a bellwether for the agency’s larger enforcement campaign against the cryptocurrency sector, the SEC v. Ripple case has Many have seen Ripple’s partial triumph as a victory for the sector, but the uncertain language of the decision and the possibility of an appeal mean that regulatory clarity still elusive. As other cases—including those involving Coinbase and Binance—move through the courts, the legal environment for digital assets keeps changing.

Possible Legislative Amendments

Legislators are becoming more and more interested in crypto control even as the legal system runs its course. Congress might decide on new laws controlling the industry before the courts render their decision. Such laws could provide much-needed clarity for the sector by perhaps addressing the legal concerns regarding digital token sales.

The Journey Ahead: Anticipation

Continuous Legal Argues and Market Uncertainty

The Ripple case could potentially continue winding through the courts for years, possibly reaching the Supreme Court by 2026 or later, as the SEC may consider appealing, extending the uncertainty even further. Of course, this scenario assumes the SEC proceeds with an appeal, but it is still uncertain whether they will do so. Other federal judges have rendered decisions on related matters in the meantime, occasionally coming to opposite results. This continuous legal uncertainty emphasizes the need of clearer regulatory rules either by new laws or court decisions.

Ripple’s Global Plan

Ripple has been growing internationally while it keeps negotiating legal obstacles in the United States. By helping Ripple to withstand some of the negative effects of the continuous litigation, this approach could enable it to keep expanding in less constrained countries. Still, the result of the SEC case will have major effects on Ripple’s operations as well as the larger bitcoin market.

Summary

For the bitcoin sector, the Ripple case is a turning point with broad consequences for US digital asset control. Although Ripple has won a half-victory, the legal fight is finished completely and will probably affect the sector’s direction for years to come. With major developments expected in the next months, both Ripple and the larger crypto market will remain under close observation as the matter unfolds.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment