Table of Contents

Introduction

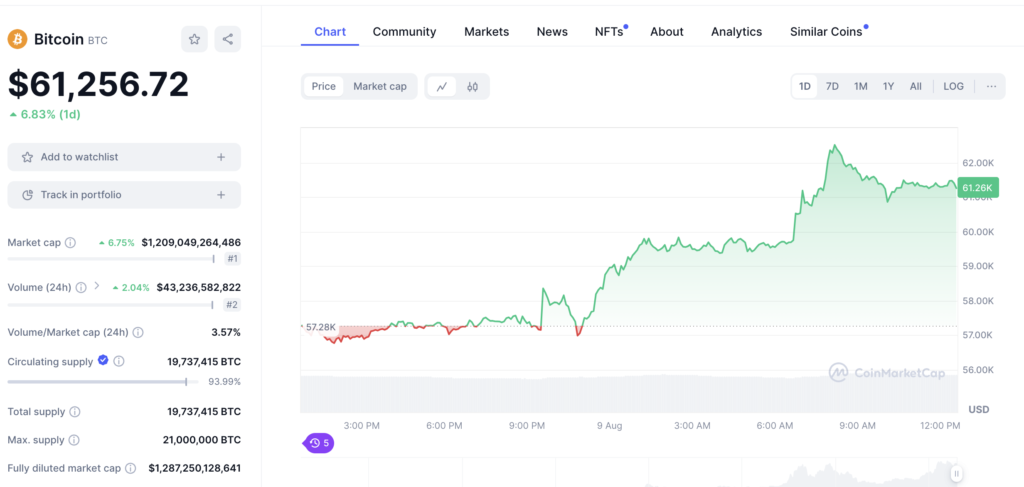

Shortly after what many are referring to as “Crypto Black Monday,” Bitcoin has made a robust comeback reclaiming $62,000. Examining Bitcoin’s price swings, macroeconomic events, and future implications for the cryptocurrency market, this paper explores the most current market trends.

The recent recovery of Bitcoin: a bullish indication?

Pattern of Bull Hammer

After falling below the $50,000 mark on August 5 and then rebounding to reach over $62,000. Referring to the positive trend on the weekly chart as a “massive bull hammer,” crypto trader Matthew Hyland pointed out This pattern points to a possible upward trend as Bitcoin might have discovered its floor.

Market Reactions following a Drop

Many traders view Bitcoin’s fast recovery to $62,510 before settling around $61,068 as encouraging. CoinMarketCap data shows that the asset has climbed by 12.46% since August 7. Some analysts believe that the recent dip was a bear trap, meant to shake out weak hands and trap short-sellers, based on the fast recovery.

The Part Institutional Influence Plays

Endorsement from Morgan Stanley

The biggest wealth manager in the US, Morgan Stanley lately let its financial advisers suggest Bitcoin exchange-traded funds (ETFs) to clients. This action is supposed to increase the attraction of Bitcoin to institutional investors, so supporting its price recovery.

Investor mood and market dynamics

Future traders’ sentiment has changed to be much toward long positions. According to CoinGlass statistics, compared to 47.52% short, 52.48% of positions are currently long. This change captures growing faith in Bitcoin’s positive path.

Different Approaches Regarding the Bottom of Bitcoin

Bearish Forecasts Based on Analyst Interpretive Notes

Not all analysts believe Bitcoin has reached its lowest even with the recent comeback. According to Markus Thielen of 10x Research, before joining the next bull market, Bitcoin might still fall into the low $40,000s. Reflecting the continuous uncertainty in the market, Timothy Peterson of Cane Island Alternative Advisors also thinks that Bitcoin might see either $40,000 or $80,000 within the next sixty days.

Market responses to economic indicators

Furthermore affecting Bitcoin’s price swings is the current information on the U.S. labor market. Strong labor market statistics published on August 5 indicated that the U.S. economy might not be approaching a recession as earlier predicted. Together with anticipations of a possible September interest rate reduction, this information has helped Bitcoin’s price recover.

The Effect of Liquidations on Price of Bitcoin

Grand Liquidations in the Futures Market

Price increase of Bitcoin has coincided with notable liquidations in the crypto futures market. Comparatively to $96 million in long liquidations, over $ 114 million in short positions were sold within 24 hours. This tsunami of liquidations has added to the pressure on Bitcoin’s price rising from all directions.

Open Interest and Funding Ranges

Further pointing to a more optimistic market is data from Coinglass showing a rise in the open interest (OI) and funding rates of Bitcoin futures. On August 8, the total number of open futures contracts came out to be $27.01 billion, compared to $26.65 billion yesterday. This rise reflects fresh market optimism and suggests that traders are once more ready to accept fresh risks.

Whale Behaviour and Consequences

Whale Count During the Dip

Market intelligence company Santiment claims that Bitcoin whales seized the recent dip to increase their holdings of the currency. As the price dropped below $50,000, wallets containing between 10 and 1,000 BTC experienced notable increase in activity. This build-up is seen as a positive indication since it shows that big players believe in the long-term future of Bitcoin.

On-Chain Metrics: Optimistic Viewpoint

According to further CryptoQuant data, 2.68 million BTC is the five-year low for Bitcoin balances on exchanges. This fall implies that investors are shifting their Bitcoin into self-custody wallets, so lowering the possibility of selling and indicating expectation of a future price rise.

Conclusion

Recent price swings of Bitcoin point to a possible turn towards a more optimistic market. Although some analysts remain wary, the mix of rising institutional interest, positive on-chain metrics, and whale accumulation points to Bitcoin perhaps seeing more gains not too distant. Investors should keep alert and take into account more general economic and market factors as the market develops.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment