Table of Contents

Emerging Crypto Hubs and Changing Market Dynamics

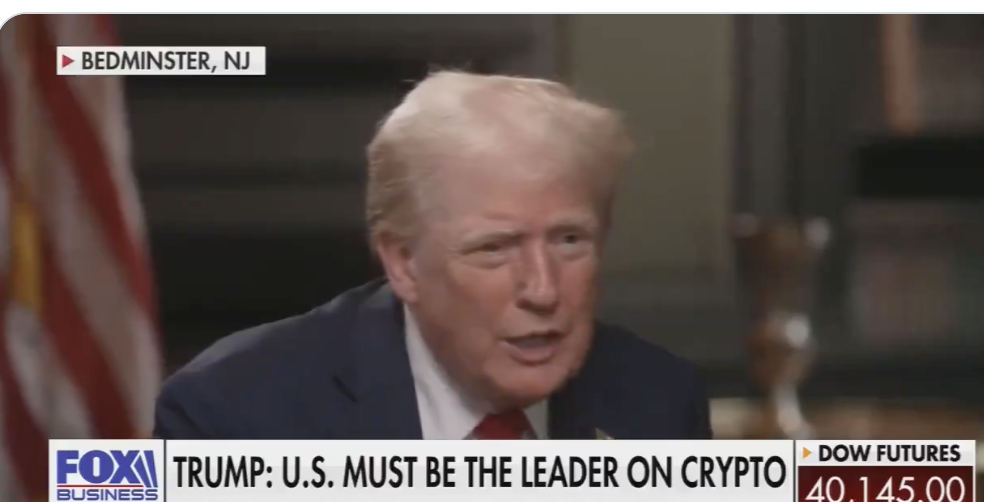

As the US political scene gets more favorable for digital assets, aspirant crypto hotspots including Hong Kong, Singapore, and Dubai are facing new difficulties. Though recent market declines, there is increasing hope that US laws are starting to support rather than oppose. Promising to make the US the “crypto capital of the planet” and threatening to fire SEC Chair Gary Gensler, who has been suppressing digital-asset companies, Republican presidential candidate Donald Trump is courting the crypto sector. Potential Democratic candidate Kamala Harris has not yet taken a strong position on cryptocurrencies, but her advisers seem to be looking for improved relations with the sector.

Kamala Harris and Advocates of Crypto Rally

Supporting Kamala Harris, a Democratic nominee, a group of “industry leaders, policy experts, and everyday crypto-enthusiasts” is helping her to create a clear policy platform on digital assets. In an Aug. 6 post on X, the group “Crypto Advocates for Harris” revealed intentions to host a virtual town hall including US legislators, legislators, and business leaders including minority owner of Dallas Mavericks Mark Cuban. Although Cointelegraph contacted Cuban for comments, at the time of publishing no reply was received.

Democratic donor Cuban from the 2024 campaign is critical of the Republican Party run under Donald Trump. Before the US President said on July 21 that he did not intend to run for reelection, he apparently intended to vote for Joe Biden. After Biden’s choice, Cuban told Politico Harris could be “far more open to business, artificial intelligence, crypto, and government as a service” than the present President. Suggesting it could cost Biden the election, Cuban has also attacked SEC Chair Gary Gensler’s enforcement actions against crypto companies.

Harris’s Potential Digital Policy

Harris, who revealed on Aug. 6 that Minnesota Governor Tim Walz will be her running mate, has not publicly expressed opinions on cryptocurrencies or proposed her platform on digital assets. Her campaign supposedly contacted Cuban in July with inquiries on crypto policy. Harris should take a “nuanced policy stance that positions America as a leader in digital assets,” the advocacy group advises. Cointelegraph was not able to access the whole attendance record for the virtual town hall, but as of Aug. 6 it included the marketing head Sam Shev from Ava Protocol and Mason Lynaugh, Stand With Crypto community director.

Trump’s Pro-Crypto Position and Capital Flow

Companies are weighing personnel moves, and venture capitalists already see more US investments. “Due to the hostile regulatory environment in the US, the availability of opportunities shifted overseas over the last couple of years,” said Cosmo Jiang, Portfolio Manager at Pantera Capital. “Our capital allocation will change as the US develops and that reverses.”

Given his past remarks disparaging the industry as a “scam,” Trump’s pro-crypto posture is a volte-face. Still, the general US scene points to the SEC crackdown’s peak as having passed. This means that Hong Kong, Singapore, Dubai, and European countries might have to put more effort into luring investment into their digital-asset centers.

Bitcoin ETFs: Market Reactions

Listed in January, the US Bitcoin ETFs have drawn some $19.4 billion in net inflows thus far, breaking records for a new fund category. Research company Kaiko claims that the dollar, which gave up its position as the most traded unit against cryptocurrencies to the South Korean won in the first quarter, reclaimed the top spot in May with more than 50% of worldwide volume.

This was a significant change from last year when companies moved abroad and trading volumes dropped in response to a series of US enforcement actions following the fall-off of the fraudulent FTX cryptocurrency exchange. Said Kelvin Koh, co-founder and chief investment officer of Spartan Capital, which runs out of Hong Kong and Singapore, a clearer US regulatory system would mean “a lot more capital heading” toward the biggest economy in the world.

Ripple Effects and worldwide influence

Given the size of US capital markets, other jurisdictions are likely to follow the lead of their regulators, thus a supportive framework could have “a broader impact.” Said Digital Asset Capital Management Co-Founder Richard Galvin. Already clear are the knock-on effects of Trump’s words. Following the former president’s July 27 speech praising ideas for a US Bitcoin stockpile, Legislative Council member Johnny Ng said he would talk on the feasibility of “including Bitcoin in financial reserves with different stakeholders” in Hong Kong.

The US already controls Bitcoin mining, the energy-intensive process used to secure the blockchain, according to crypto entrepreneur Justin Sun, developer of the Tron blockchain. After a crypto ban in China in 2021 crushed such activity there, the US became leading in mining. Sun maintained that China does not want to lag behind in the general growth of digital assets in spite of the ban. He foresaw rivalry between Washington and Beijing that will “greatly benefit” the growth of the crypto market.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment