Table of Contents

Introduction

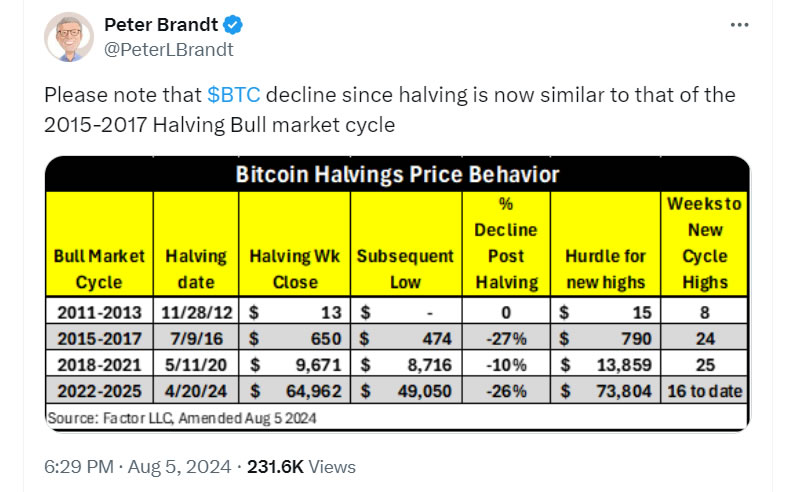

Veteran trader Peter Brandt is making analogies to the market movements that preceded the bull run that happened in 2016 as the price of bitcoin has lately dropped following the halving that took place in April 2024. “BTC decline since halving is now similar to that of the bull market cycle that occurred between 2015 and 2017 when halving occurred,” Brandt said on X on August 5.

Comparing Historical Market Corrections

Trends in Previous Years’s Market

Brandt compared the degree of market corrections following the halving and discovered rather interesting parallels. On July 9, 2016—the day the bitcoin halved—the price of the coin was $650. The market dropped 27% straight after the halving, declining to $474 in a month. A meteoric climb to a cycle high of $20,000 in December of 2017 came next.

Recent Declining Rates

In a same line, the recent drop below $50,000 marks a 26% drop from the price of $64,962 attained following the halving process. According to CoinGecko, the price of Bitcoin had dropped to $49,221 as of August 5. From its late July peak of $70,000, this shows a 20% drop. Nevertheless, signs of a recovery surfaced when Bitcoin restored its former price of $56,000 on early Asian trading on August 6.

Market Analysis and Predictions

Comparison to 2019 Patterns

The founder of ITC Crypto, Benjamin Cowen, noted on August 5 that the present trend resembles that of 2019, in which the markets saw a surge in the first half of the year followed by a notable downturn in the second half.

Potential for Faster Recovery

Tim Kravchunovsky, the CEO and founder of Chirp, a distributed telecommunications network, said in an interview with Cointelegraph that, in a way similar to the recovery it underwent in 2020, cryptocurrency assets may recover more quickly than other risk assets. “The great selloff is not a crypto-specific issue; macroeconomic factors are in the driving seat,” he told reporters. Kravchunovsky put out the idea of decoupling cryptocurrencies from conventional stocks, which would produce a more marked and faster recovery.

Factors Influencing Bitcoin’s Future

Macroeconomic Influences

The main causes of the current selloff are a larger spectrum of macroeconomic elements. Analyzers believe that once these elements stabilize, Bitcoin and other cryptocurrencies might separate from conventional stocks, possibly reflecting the quick recovery noted in 2020 following the fall of the epidemic.

Recovery Scenarios

While some analysts predict a slow down in Bitcoin, others see a quick comeback. The market is closely monitoring the movement of Bitcoin and expects either a notable comeback or a continuous drop in value of the coin.

Conclusion

Drawing comparisons to past times when the cryptocurrency underwent bull runs and corrections, the latest drop and partial recovery of Bitcoin reflect historical market trends. Although some predict the recession to continue, others see a quick recovery influenced by macroeconomic environment stabilization. Though the market is negotiating these swings, future developments of Bitcoin remain a topic of great debate and speculation.

Key Takeaways

- Bitcoin’s decline since the April 2024 halving resembles the 2015-2017 bull market cycle.

- Historical patterns show similar declines post-halving followed by significant recoveries.

- Recent market activity indicates a potential for a swift recovery, influenced by macroeconomic factors.

- Analysts are divided on whether Bitcoin will continue to drop or bounce back quickly.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment