Table of Contents

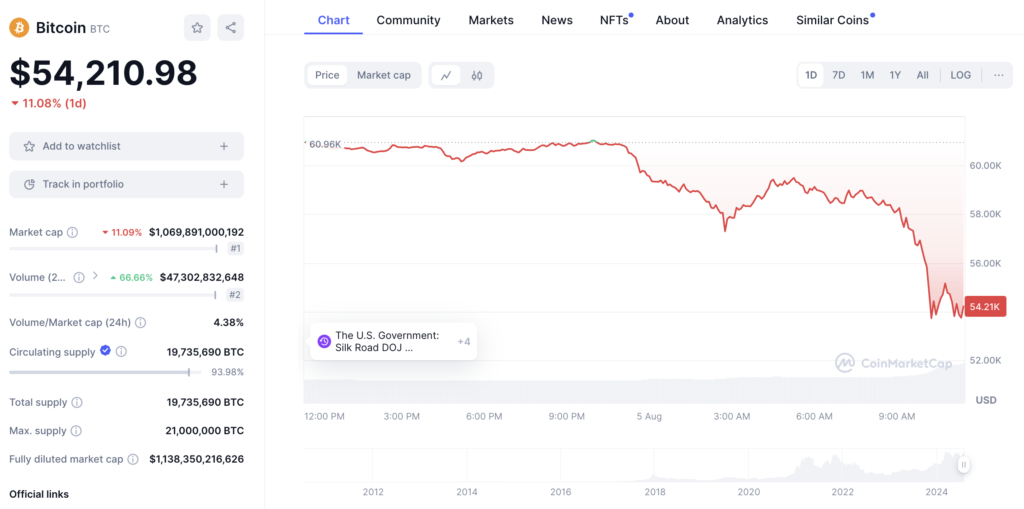

On August 5, the price of Bitcoin experienced a significant drop, falling by 10% from $58,350 to $52,500 in just two hours. Since then, the cryptocurrency has made a slight recovery, and according to data from TradingView, it is currently trading at $54,210.

Recent Market Performance

The last time Bitcoin was traded at a price lower than $53,000 was on February 26 of this year, shortly after the United States government gave its approval for spot Bitcoin exchange-traded funds (ETFs). A similar pattern was observed with Ethereum’s price, which experienced a significant decline as well, falling by 18% from $2,695 to $2,118 during the same time period. At this moment, the price of Ethereum has recouped to $2,358.

Impact on Leverage Positions

As a result of the precipitous drop in the prices of cryptocurrencies, leverage positions totaling more than $740 million have been wiped out in the past twenty-four hours. According to the data provided by CoinGlass, approximately 644 million dollars worth of leveraged longs were liquidated. Ethereum traders were the ones who were hit the hardest, with over $256 million worth of ETH longs being liquidated and nearly $231 million worth of Bitcoin longs being forcibly closed.

Increasing Open Interest in Ethereum

Over the course of the past few months, there has been a substantial rise in open interest for Ethereum. This is due to the fact that traders have been looking for opportunities to gain exposure to the asset after the approval of spot Ether ETFs in the United States. During the most recent market downturn, this increased interest has been a contributing factor to the large liquidations that have taken place.

Influence of Japanese Market and Global Economic Factors

The recent decline in the prices of cryptocurrencies has occurred at the same time as a significant sell-off in the Japanese stock market. As early trading hours have begun, the Nikkei 225 has experienced a decline of 7.1%, and Japanese bank stocks have encountered their worst performance since 2008 as a direct result of a decision made by the central bank to raise interest rates.

Total Crypto Market Capitalization

Because of the sudden market crash, the total market capitalization of cryptocurrencies was temporarily reduced by as much as $500 billion in just three days. This represents the largest loss in a span of 72 hours in more than a year.

Underlying Causes of Market Turmoil

According to a number of market analysts, the recent volatility can be attributed to a number of factors, including weak data on employment in the United States, slowed growth among leading technology companies in the stock market, and concerns regarding the possibility of mass selling by Jump Crypto, a cryptocurrency trading firm.

Future Outlook and Key Levels to Watch

It is possible that Bitcoin will remain stable around the $54,000 mark if it continues to maintain its current momentum. Bitcoin, on the other hand, may continue to fall toward important support levels if the downward pressure continues. Participants in the market ought to keep a close eye on these developments as well as the broader economic indicators that are influencing the cryptocurrency market.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment