Table of Contents

The market for cryptocurrencies has revolved mostly on Bitcoin’s recent pricing performance. Though the new month has started slowly, issues of discussion on August’s historical performance of Bitcoin have emerged. Investors have some hope since a well-known blockchain company has indicated that a price rebound could be on store.

Potential Bitcoin Bottom: What’s Next?

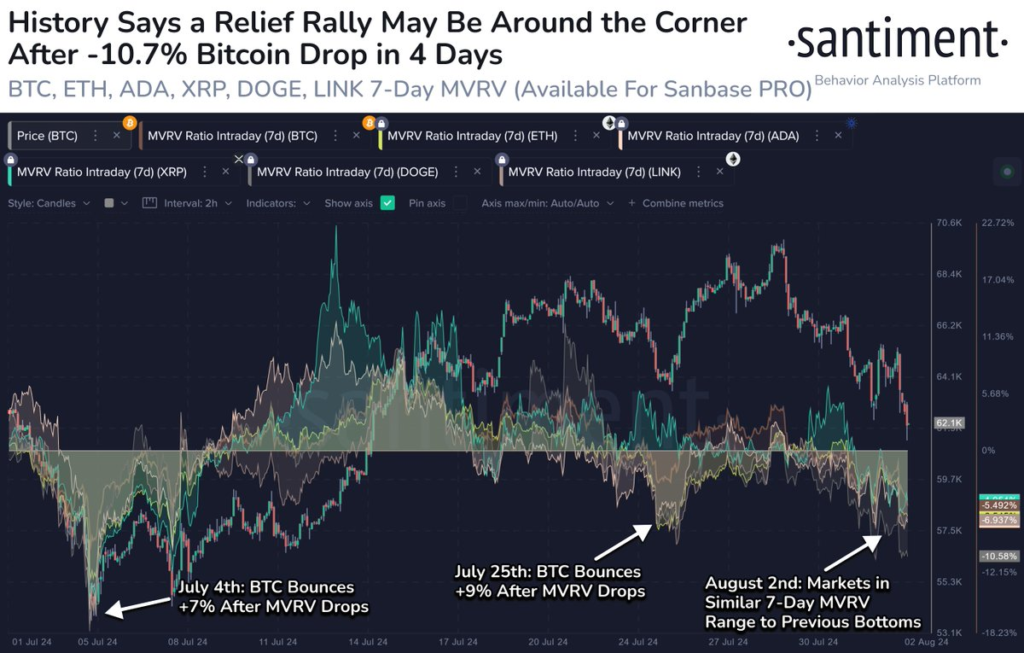

Prominent cryptocurrency analytics tool Santiment has revealed that a “relief rally” for Bitcoin’s price might be just around the bend. This hopeful projection is much-needed following a week of poor performance of Bitcoin and other large-cap cryptocurrencies.

Based on the Market Value to Realized Value (MVRV) ratio intraday—a gauging of the average profit or loss experienced by Bitcoin owners on a given day— Santiment’s forecast is One especially helpful use of this indicator is in spotting times when Bitcoin is either underpriced or overpriced.

Understanding the MVRV Ratio

It suggests that when the MVRV ratio exceeds zero percent more traders are profitable. Traders have a propensity over history to sell profitable assets in order to make money. Conversely, an MVRV ratio less than 0% suggests that more traders are losing, which would mean that Bitcoin might be underpriced.

With an MVRV ratio of -5.5%, Bitcoin’s current value implies that the bitcoin may be underpriced right now. Low MVRV ratios have historically been connected to the availability of chances for low-cost purchase.

Historical Price Movements

Historically, the price of bitcoin has risen whenever the MVRV ratio has dropped to levels now being seen. The MVRV ratio dropped to -5% on July 4 and then July 25, respectively, thus the price of Bitcoin rose by 7% and then by 9%.

Santiment also pointed out that, in terms of their present positions, other big-cap cryptocurrencies including ETH, ADA, XRP, DOGE, and LINK resemble Bitcoin. The drop in their MVRV ratios suggests that these assets might have a price comeback.

Current Bitcoin Price Overview

The price of Bitcoin at the time of this writing is about $61,300, a drop of more than 5% over the last day. The value of the bitcoin has dropped by almost ten percent during the past eight days, according to CoinGecko’s data.

Conclusion

Recent price swings in Bitcoin and the current MVRV ratio both point to a possible purchase opportunity since they suggest that the bitcoin might be undervalued. Based on historical observations of patterns, the price of Bitcoin might rise following a declining MVRV ratio. To make well-informed decisions, investors should closely monitor these indicators in addition to the general mood of the market.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment