Table of Contents

Whale Activity Surges as Bitcoin Leaves Exchanges

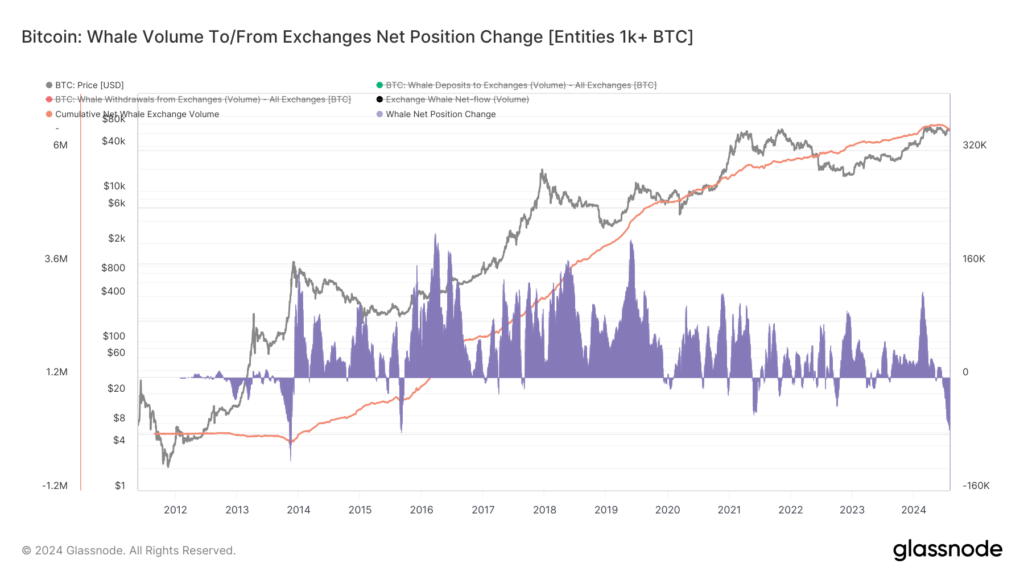

Even though the market has been relatively stable recently, Bitcoin whales, which are defined as addresses that hold more than 1,000 Bitcoins (approximately $64 million), have significantly increased their holdings, adding 84,000 Bitcoins in the month of July. Bitcoin is being removed from exchanges at a rate that has not been seen since 2015, thanks to these large holders.

Major Outflows from Exchanges

Bitcoin whales are not deterred by the current lackluster momentum in the BTC/USD pair; they continue to amass Bitcoin and withdraw it from exchanges. According to the whale net position change metric that Glassnode provides, Bitcoin whales have been responsible for the most Bitcoins being removed from exchanges since the year 2015. In the past thirty days, approximately 64,000 Bitcoins have been removed from whale exchange balances. Since September 2015, when the price of Bitcoin was at its lowest point around $220, this represents the largest negative net position change for exchange whales.

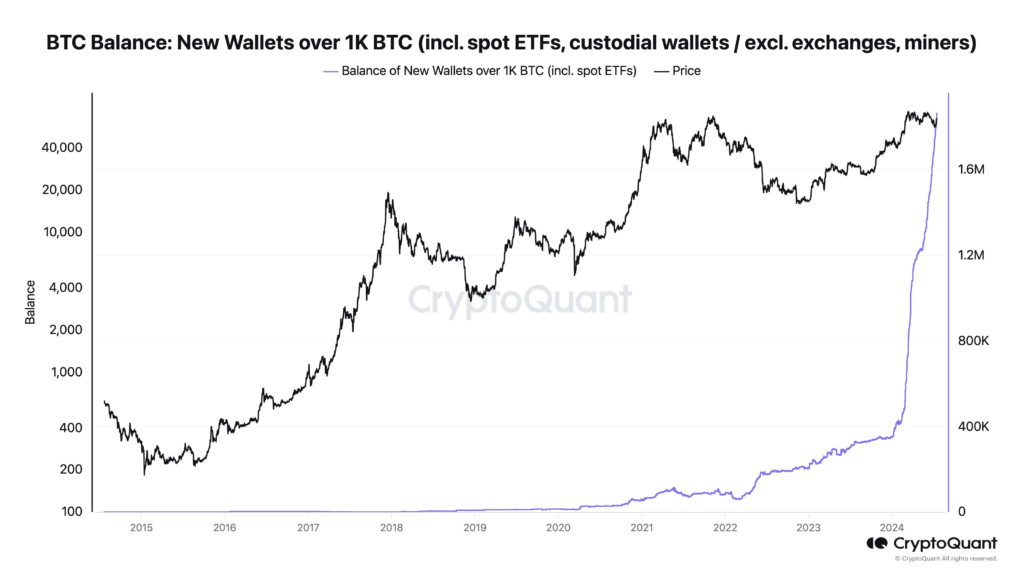

The Chief Executive Officer of CryptoQuant, Ki Young Ju, brought attention to the fact that whale wallets, which include spot ETFs and custodial wallets, have added an average of more than 100,000 BTC per week this year, bringing the total amount of BTC to 1.8 million. As he pointed out:

While spot exchange-traded funds (ETFs) and custodial wallets added 1.45 million BTC this year, whale wallets (more than one thousand BTC) added 1.8 million BTC. During the course of the year 2021, approximately seventy thousand bitcoins were received; at the present time, one hundred thousand bitcoins are received each week.

The number of whale addresses that held at least 1,000 BTC increased from 1,498 at the beginning of the year to 1,651 as of the first of August, according to data stored on Glassnode.

Is Bitcoin’s Bottom In?

There is a possibility that the price of Bitcoin has established a new local bottom above the $63,000 mark, which has previously served as a significant support on the four-hour chart previously. Elja, a crypto analyst, made the following reaction to a post on X on August 1:

“BTC has reached its lowest point. The time has come to light some large green candles.

The completion of a monthly bullish close above a key macro level of $61,600 by Bitcoin contributed to the optimistic outlook that was already present. Titan, a well-known cryptocurrency trader, made the following observation:

In spite of the turmoil, Bitcoin was able to maintain its position above a significant macro level. It is very encouraging to hear this. It is possible that the summer will bring about a dull market, but the months that are to come are going to be very interesting.

Psychological Resistance and Future Projections

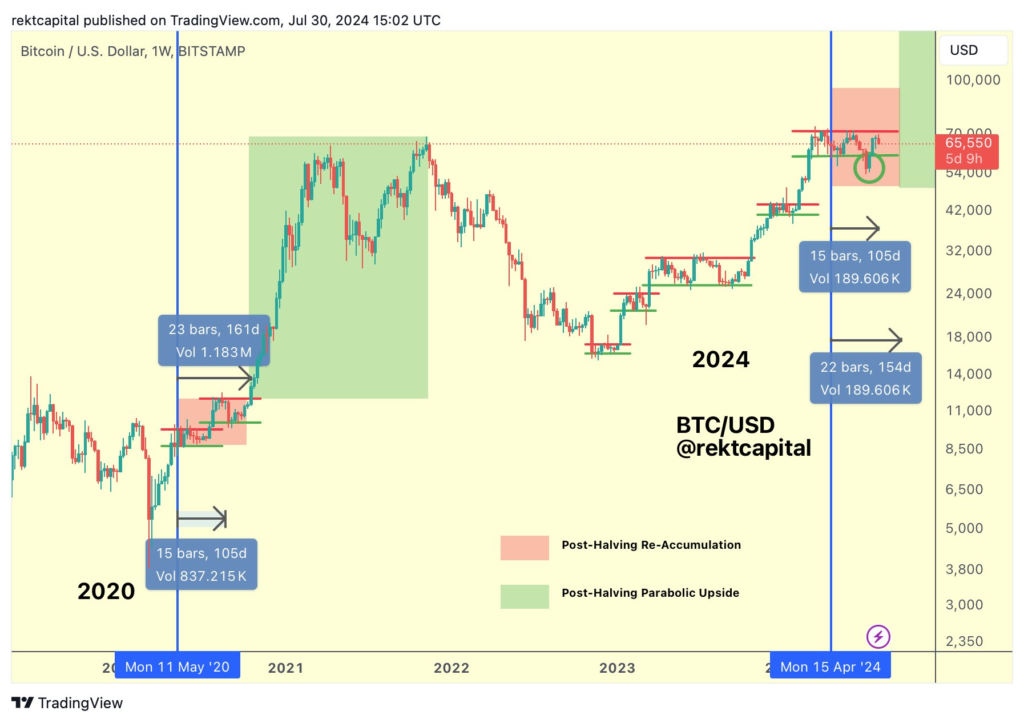

Bitcoin, on the other hand, encountered resistance at the psychological level of $70,000, which indicates that it may continue to experience range-bound behavior until September. Rekt Capital, an analyst, announced that

As of right now, Bitcoin is still on track to make a breakout in September. According to the historical evidence, it was always a highly improbable occurrence for a breakout from the ReAccumulation Range to occur just about one hundred days after the Halving.

When looking for a possible rebound, the key support levels to keep an eye on are $63,000 and somewhere around $57,000.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment