Table of Contents

Market Summary and Institutional Adoption

The Q2 2024 XRP Markets Report by Ripple exposes notable developments in the crypto sector. The quarter concentrated on institutional adoption, with US approval of ETH spot ETFs. After the success of Bitcoin spot ETFs, this mark denotes a maturing market. Analysts predict this would cause other ETFs—including Solana—to be approved. Market mood was shaped by macroeconomic variables including inflation, expectations on interest rates, and unemployment rates. Especially, Bitcoin’s relationship with the S&P 500 changed from 0.2 to 0.4, suggesting a “flight to quality” as top ten market capitalization tokens performed better while smaller cap tokens suffered notable drawdowns.

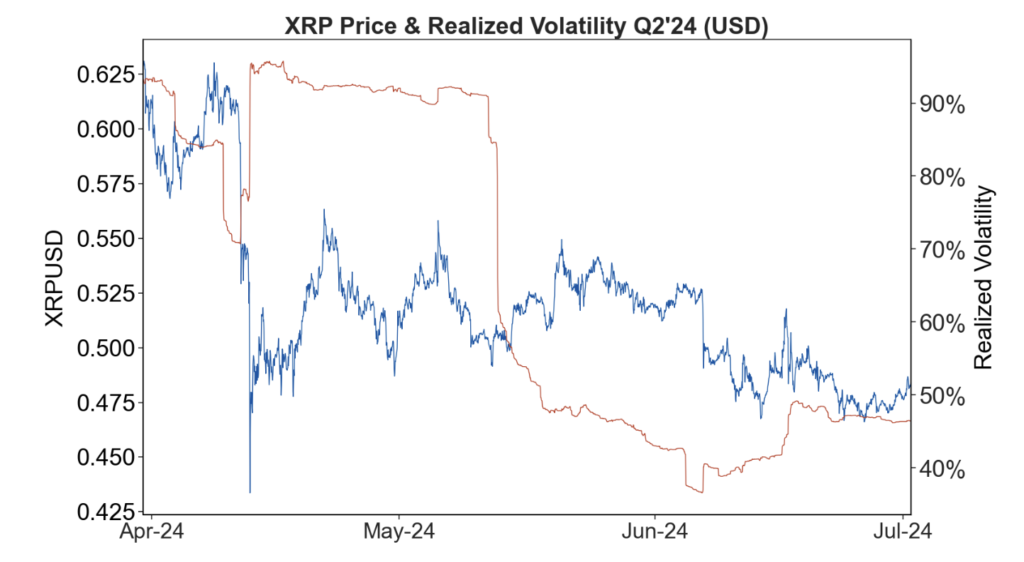

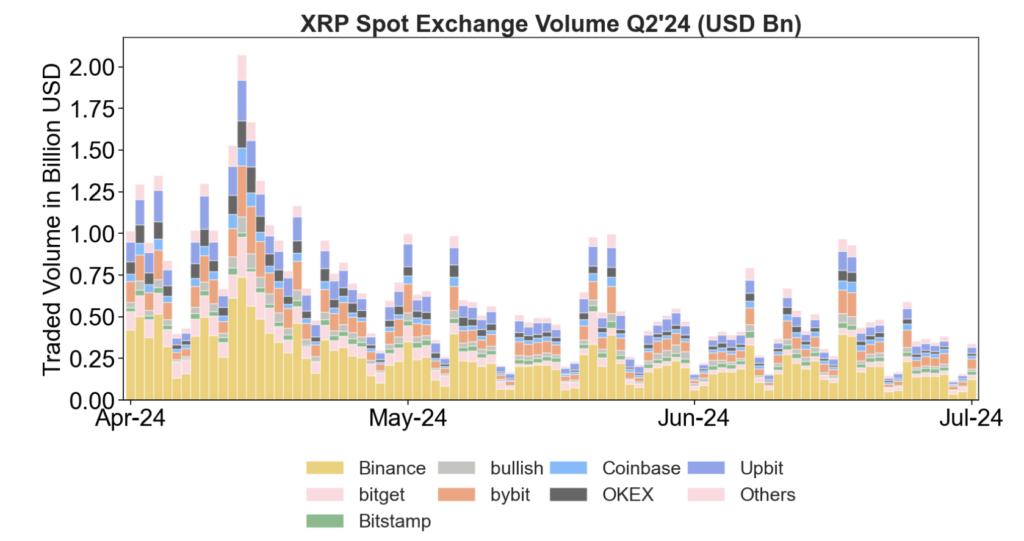

Market Volatility and Trading Volumes

With average daily trading volumes for BTC, ETH, and XRP declining by 20% from Q1, the crypto market displayed notable volatility. Affected by events including the BTC halving in April and distributions connected to the Mt. Gox legal dispute, Bitcoin’s price momentarily dropped below $60,000.

Regulatory Wins and Legal Milestones

The one-year anniversary of Ripple’s historic triumph over the SEC in July helped to clear XRP as not a security. Ripple is still awaiting a court ruling on remedies pertaining to institutional sales before December 2020. Apart from one individual state law claim, a California Court also dismissed all class claims against Ripple depending on federal and state laws.

Global Regulatory Developments

The crypto sector sees the US elections of 2024 as absolutely vital. Ripple made a $25 million donation to Fairshake, a federal super PAC endorsing pro-crypto political candidates, so bringing their overall contribution to $50 million. Globally, authorities are working to establish crypto hubs. While the Central Bank of Brazil announced intentions for a regulatory framework for token creators and virtual asset service providers by year-end, Hong Kong has published consultation conclusions on a licencing regime for stablecoin issuers. The UAE released the Payment Token Services Regulation in the Middle East, and on June 30 the MiCA rule became operative for stablecoins in Europe.

XRP Markets Analysis

According to Ripple’s report, XRP showed high volatility in early Q2, with values ranging from $0.43 to above $0.62. At first above 90%, realized volatility dropped to roughly 45% as the quarter went on. XRP trading volume was mostly accounted for by Binance, with Bybit and Upbit also making a big contribution.

Innovations on the XRP Ledger

Axelar will be the exclusive bridge used by the XRPL EVM sidechain to source the native gas token (eXRP), according to ripple. This cooperation seeks to improve interoperability and offer a safe link for users. Among the important changes are the addition of oracles on XRPL that provide consistent data feeds for DeFi apps and smart contracts. Set to be published in Q3, the Multi-Purpose Token (MPT) standard will enable the building of intricate token structures reflecting several assets and rights.

Tokenized Real-World Assets on XRPL

UK-regulated digital asset exchange, broker, and custodian Archax revealed intentions to bring hundreds of millions of tokenized RWAs onto the XRPL over the next year. Ripple also started a fund to foster XRPL innovation in Korea and Japan.

Introduction of Ripple USD Stablecoin

Later this year, Ripple intends to introduce a stablecoin, Ripple USD. Short-term US government treasuries, US dollar deposits, and other cash equivalents will all 100% back the stablecoin. Plans call for expanding to other blockchains and DeFi systems over time, thus it will be accessible on the XRP Ledger as well as Ethereum blockchains.

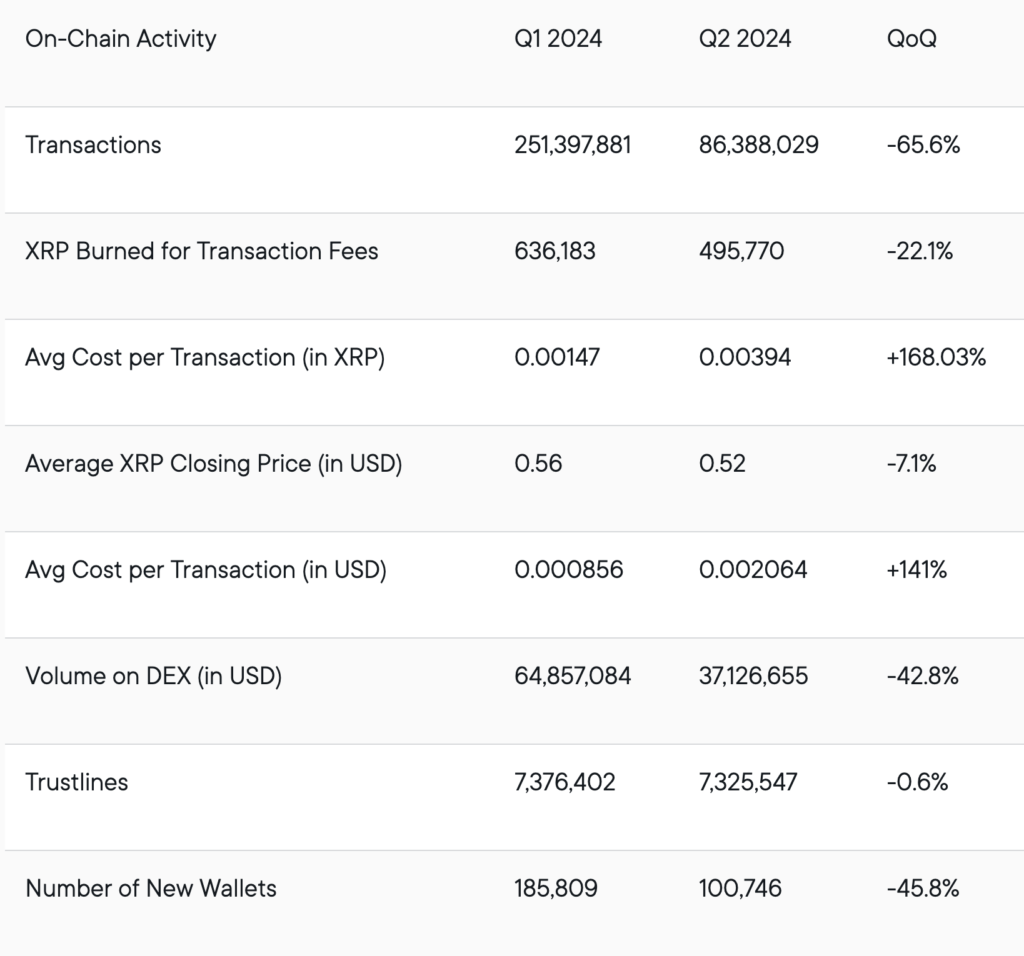

On-Chain Activity and XRP Holdings

On-chain activity across main protocols—including XRPL—dropped in Q2 relative to Q1. Volume on the DEX dropped; XRP burned for transaction fees saw declines as well. Ripple reports XRP levels at both ends of every quarter. Ripple had 4.68 billion XRP as of June 30, 2024; 39.5 billion XRP subject to on-ledger escrow lockdowns.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment