Table of Contents

Current Bearish Trend in Ethereum

With Ethereum experiencing a protracted bearish trend, many traders and investors are left unsure. The price of the altcoin has been declining and shows no clear indication of quick comeback. Still, there are underlying positive signals implying a possible change in the dynamics of the market.

Whale Accumulation: A Bullish Indicator

On-chain data has lately shown a notable accumulation trend for Ethereum ( ETH). The actions of big investors, sometimes known as “whales,” who have been buying significant volumes of Ethereum have produced this optimistic catalyst. These whales, who have acquired ETH worth hundreds of millions of dollars, show their expectation of a forthcoming price explosion.

$440 Million ETH Purchase by Whales

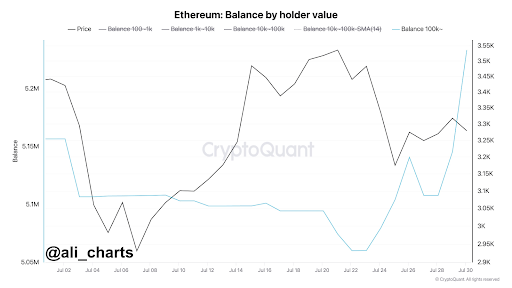

On social media platform X, eminent crypto analyst Ali Martinez exposed this interesting accumulation trend. Data from CryptoQuant shows that within just 48 hours, Ethereum whales have lately made a significant movement accumulating 126,000 ETH, valued at almost $440 million. Based on the study, addresses with more than 100,000 ETH each—classifying them as ultra-whales—driven this buying trend mostly.

Impact of Ultra-Whales on Market Trends

Among the most powerful and significant Ethereum market investors are some ultra-whales. Their actions sometimes clearly affect investor attitude and market trends. The CryptoQuant chart showed a notable rise in the overall balance kept by these top players. These ultra-whales had cumulative holdings of about 5.1 million ETH on June 28; by June 30, their holdings had surged to over 5.23 million ETH. When one considers the balance from an earlier point—that of 5.05 million ETH on July 22—this increasing trend is even more clear.

Reasons Behind the Accumulation

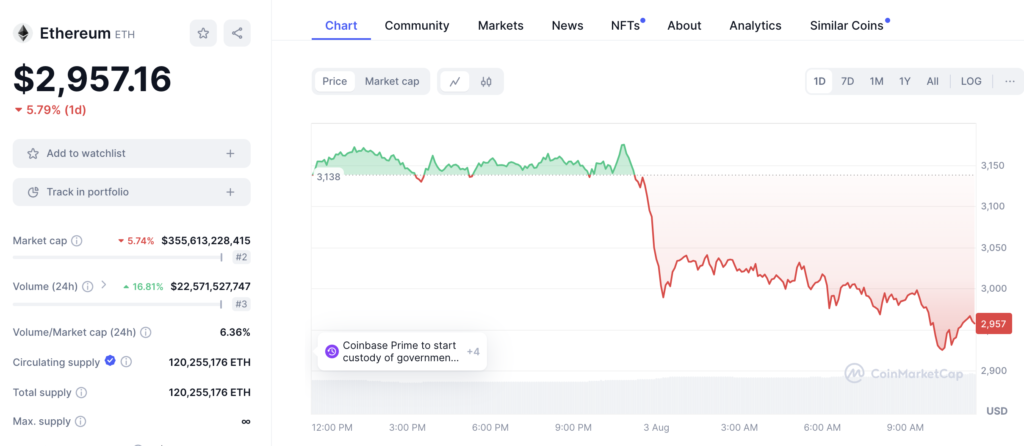

Whales positioned themselves for a predicted bull run, influenced by Spot Ethereum ETFs, can help to explain the build. These spot ETFs are starting to show a change as collective inflows into other Ethereum ETFs start to exceed outflows from Grayscale’s ETHE. Spot Ethereum ETFs have started a sell-the-news event even though their introduction has not yet produced a price surge for Ethereum. ETH has dropped about 12.8% since its introduction, lately bottoming at $3,090.

Market Sentiment Remains Bullish

Many analysts, in spite of this decline, have a positive opinion of Ethereum. This indicates that, despite mostly psychological nature, investor confidence is still rather strong. Ethereum is trading at $3,150 right now for writing. Based on on-chain data from CryptoQuant, many whales—expectedly driven by Ethereum—are getting ready for an altcoin surge.

Preparing for an Altcoin Rally

Limit buy order volumes for altcoins are rising across many exchanges, according to on-chain buying trends. This has produced significant buy walls reflecting preparations for an altcoin surge. On the daily chart, Ethereum’s price is trending down; but, the accumulation by whales points to a positive future.

Conclusion: Ethereum’s Potential Bull Run

One clear sign of a possible bull run is the $440 million worth of Ethereum accumulated recently by whales. Two important events that might influence Ethereum’s price rise are the activities of ultra-whales and the launch of Spot Ethereum ETFs: These events should be watched by investors since they indicate the start of Ethereum’s new optimistic phase.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment