Table of Contents

Introduction: Understanding Crypto Market Cycles

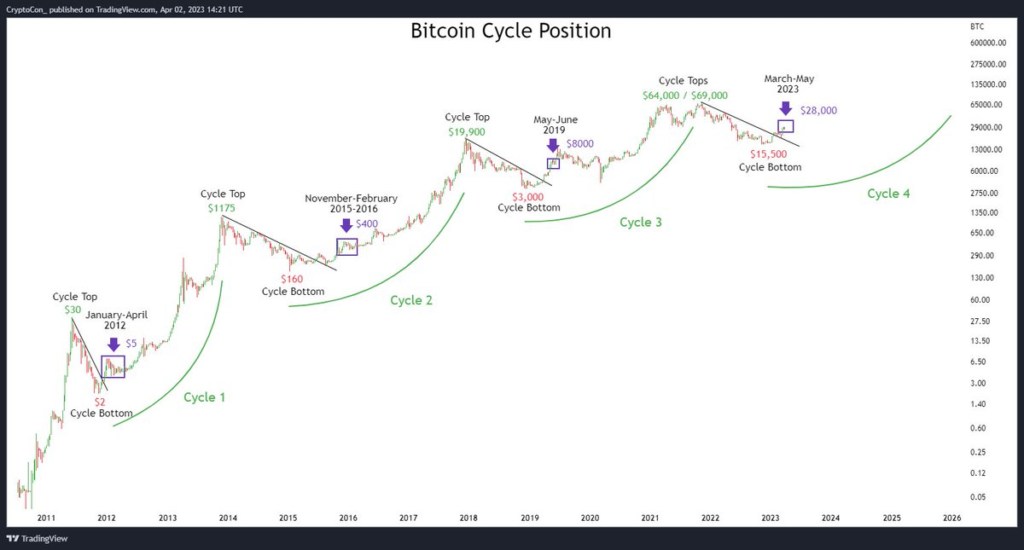

Though it is rather short, cryptocurrencies have gone through notable cycles of rise and fall over their existence. Among these cycles, Bitcoin—which is commemorating its 15th anniversary right now—has been rather noticeable. In 2011–2013, 2015–2017, 2019–2021 respectively there were notable bull markets. Given that the bitcoin market is open around-the-clock—about five times more than conventional equity markets—it is not surprising that these cycles arise so rapidly. Once the US market starts to show indications of warming up ahead of the election and as liquidity conditions keep improving, history might repeat itself once more.

— — — — —

BTC Leading the Charge in Crypto Rallies

Establishing a basis of confidence, Bitcoin has always been the leader of the initial market surge over past cycles, so facilitating larger market participation. Between 2015 and 2017 as well as between 2019 and 2021, Bitcoin’s supremacy helped shape the market prior to alternative cryptocurrencies attracting capital. This change indicated a rotation of investment into alternative cryptocurrencies since it often coincided with the highest point of dominance of Bitcoin’s market cap. From its lows following the FTX, the predominance of Bitcoin is currently rising, suggesting that there is possibility for more Bitcoin gains before a major altcoin surge.

Altcoins’ Strong Performance in Later Cycle Phases

In the latter phases of bull cycles, alternative cryptocurrencies have often outperformed Bitcoin. This trend shows the growing risk appetite of investors as well as the reflexive character of the alternative bitcoin market, which is confronted with rising risk capital. While Bitcoin’s returns over the second half of the cycle—2015 to 2017—were just 26 times, alternate cryptocurrencies showed returns of 344 times. Altcoins returned 16 times over Bitcoin’s return of 5 times, much as they outperformed Bitcoin during the 2019–2020 cycle. Alternative cryptocurrencies are showing a minor lag as we proceed in the current cycle, suggesting that there could be an approaching phase in which they greatly outperform it.

The Impact of Macro Economic Factors

Like other high-risk assets, the state of global liquidity affects cryptocurrencies markets in a major manner. Thirty to fifty percent more global net liquidity existed in the two cycles before this one. The tightening of liquidity helped to somewhat explain the recent second quarter selloff. Still, the second quarter’s data show that economic growth and inflation are slowing down, which is encouraging for Federal Reserve rate cutting prospects. Market projections for a September interest rate drop from 50% to over 95%, since the start of the third quarter. The increasing relevance of crypto policy in the United States election, with endorsements from well-known political personalities, is another element that might influence market dynamics even more.

— — —

Will This Cycle Differ from the Past?

Though it rhymes often, history is not exactly repetitious. Another surge in altcoins could be set up by the familiar pattern of Bitcoin leading, followed by swings in altcoins, and macroeconomic events shaping market trends. On the other hand, several fresh elements are involved here. Supported by large inflows from retail and institutional investors, the widespread acceptance of Bitcoin and Ethereum through exchange-traded funds (ETFs marks a new era. At the same time, the market for cryptocurrencies has gotten more congested as a lot of other cryptocurrencies fight for investor interest. Many of these initiatives have a limited supply that is now in use on account of airdrops, which might cause future dilution. Only ecosystems with strong technology as well as strong developer and user communities have the chance to flourish in the current surroundings.

Conclusion: Navigating the Current Market for Existing Bitcoins

Investors must have a strong awareness of the historical background as well as the present market dynamics as we negotiate yet another possible bull cycle. The market offers a lot of important prospects since Bitcoin is still proving its supremacy and alternative cryptocurrencies are ready to show possible benefits. On the other hand, two elements underlining the need of careful choice and a concentration on essentially strong projects are the crowded field and the possibility of dilution.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment