Table of Contents

Introduction: Resurgent Activity of the Utility for Bitcoin Network

Recent on-chain data points point to a possible new price surge based on a notable comeback in the utility of the Bitcoin network. The rise in utility, calculated by Bitcoin circulation, shows this clear change in investor activity and interest.

——

Understanding of Circulation of Bitcoin and Its Effects

One important statistic tracking daily movement of a unique count of tokens on the BTC blockchain is bitcoin circulation. By counting each token only once, independent of trading frequency, circulation provides a more accurate picture of network utility than transaction volume, which can be distorted by repeated trading of the same tokens. Usually, a rise in circulation indicates a growing interest and usage among investors, so reflecting a strong, active network.

Latest Changes in Bitcoin Movement

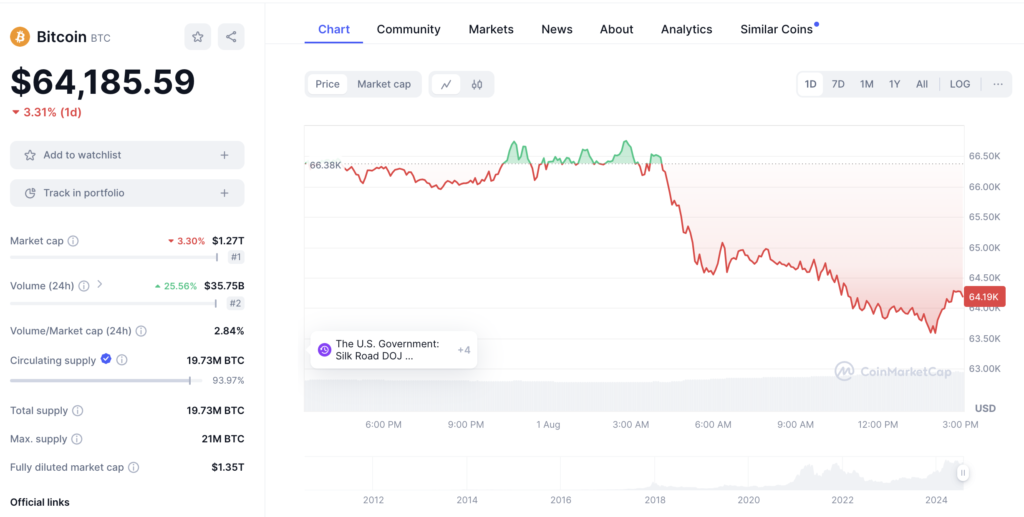

Data from on-chain analytics company Santiment shows that bitcoin flow has peaked five months ago. Following a period of low activity, this increase reflects a comeback in investor interest in Bitcoin. The most recent statistics shows that, the highest number since March 5th, when Bitcoin was on the verge of an all-time high, 244,000 distinct tokens have been transacted on the blockchain.

——

Utility’s Relationship with Bullish Trends

Positive market times have historically been linked with higher utility on the Bitcoin network since more people are interacting with the coin. Long-term price hikes find a basis in this higher activity. The recent rise in circulation levels, which reminds one of the levels seen during the Q1 bull run, increases the possibility for another significant price movement.

— —

Prospective New Bitcoin Rally

The revival of Bitcoin’s network utility has favorably affects on its possible price increase. Whether this higher activity will cause a long-lasting surge is unknown, though. The volatility of the bitcoin market means that other market factors have a major impact even if more utility could help to enable price rises.

—–

The Bitcoin Market’s Present Situation

Having momentarily reached $70,000 earlier in the week, Bitcoin is now trading at about $64,000. The latest price swings highlight the dynamic and regularly erratic character of the crypto market. Investors and analysts are closely tracking these patterns to estimate the likelihood of a fresh rally.

Conclusion: The Part Bitcoin Plays in Utility Monitoring and Market Dynamics

As the network utility of Bitcoin returns to levels last seen in major bullish phases, market players are predicting a fresh surge. Future market movements will be assessed depending on continuous observation of on-chain indicators, such circulation. The inherent uncertainty of the bitcoin market makes even if the present indicators are positive a cautious and informed approach is absolutely necessary.

Disclaimer

This is just meant to be information; it is not financial or investment advise. Unexpected changes in market conditions mean that before making any financial decisions, one must carefully study and consult a professional.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment