Table of Contents

Introduction: The Stagnant Bitcoin Price

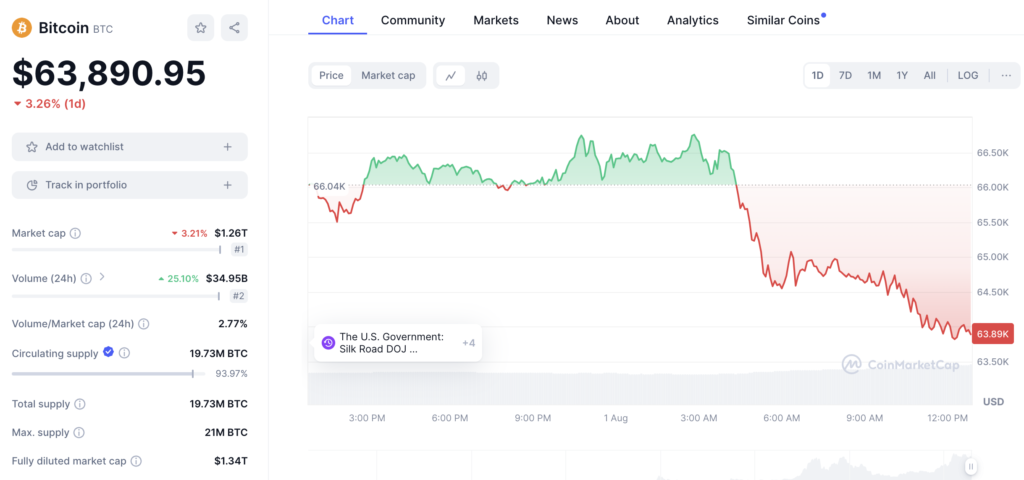

With challenges close to its highest value of almost $69,000 recorded in 2021, the price of Bitcoin has stayed limited within a range of $65,300 to $68,400. The price has stayed constant despite many efforts to get beyond this challenge, implying a phase of consolidation in the bitcoin market.

Important thresholds of support and resistance

Driven by changes in U.S. political debates on the cryptocurrency sector and the expectation of Ethereum exchange-traded funds (ETFs) in the United States, Bitcoin jumped past the $64,000 mark on July 19. Still, Bitcoin has struggled to keep on toward the $70,000 mark. Independent trader and analyst Skew claims that Bitcoin is in a state whereby demand and supply of the coin balance each other.

From a peak of $70,000 on July 29th to a minimum of $65,280, Bitcoin lost value. The variations in price have led to the development of a new range of prices where demand is strong, more especially between $65,000 and $62,000. Simultaneously, supply at rates ranging from $70,000 to $72,000 is being presented in more and more. The continuous struggle between supply and demand has kept the price within a limited range.

Understanding Market Dynamics: Bid and Ask Orders

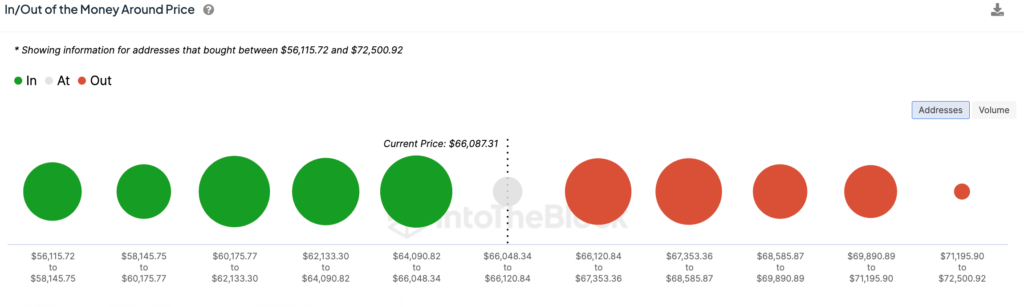

Coinglass data shows that buy and sell orders accumulating in close proximity to the current market price are rather large. Sales orders ranging from $66,800 to $67,000 are estimated to be worth $40.6 million; buy orders ranging from $66,000 to $65,370 are valued roughly $60 million. The combination of these orders points to a market in which attitudes toward optimism and pessimism are in balance.

Further research by market intelligence company IntoTheBlock shows that Bitcoin is now limited by two important levels. Considered a vital support zone, the price range of $60,000 to $66,000 saw the acquisition of 2.34 million BTC by 4.9 million addresses. Conversely, the range of resistance between $66,500 and $70,000 is defined by roughly 2.94 million BTC kept under about 5.2 million addresses. This puts a challenging scenario for the price to exceed in place.

The measure of the past variations in the price of a financial instrument is known as historical volatility. It helps one evaluate the degree of risk connected to a purchase. Conversely, market stability is the general consistency and lack of notable swings in the market. Understanding these two ideas helps one to grasp

Historically, Bitcoin has shown rather low degrees of volatility. According to CryptoCon, an analyst using a false name, Bitcoin has now gone through 96 straight days of low price volatility—the longest period of which in the present market cycle. Currently at 6.82, the 5-day Historical Volatility Index is much below its highest point of 42.7 in 2021, implying that market activity is currently limited.

The extended period of low volatility of the present suggests that the market is in a phase of consolidation marked by negligible near future price fluctuations. Still, historical patterns point to the need of closely monitoring market conditions since they imply that long stretches of low volatility usually precede notable price swings.

Summary: Understanding the Current Bitcoin Market Trends

The current Bitcoin market shows balance between buyers and sellers, in which case significant support and resistance levels take front stage. Given the stability of the market, traders and investors should closely check on-chain metrics and technical indicators to help them to predict any possible changes. While the present lack of development suggests a period of merging and strengthening, the erratic character of the bitcoin market suggests that significant changes can occur fast.

For further insights, visit our cryptocurrency website

Explore more about [Bitcoin’s price movements and market trends]

Be the first to comment